| | | | | |

| 1) | All entries exclude beneficial ownership of shares that are issuable pursuant to awards that have not vested or that are not otherwise exercisable as of the date hereof and which will not become vested or exercisable within 60 days of February 22, 2023.

|

| 2) | Calculated based on 19,056,311 shares of our Common Stock outstanding on February 22, 2023, with percentages rounded to the nearest one-tenth of one percent. Shares of Common Stock subject to options that are presently exercisable or exercisable within 60 days are deemed to be beneficially owned by the person holding the option for the purpose of computing the percentage ownership of that person but not treated as outstanding for computing the percentage of any other person.

|

| 3) | On August 25, 2014, pursuant to a Stock Purchase Agreement, the Company issued 2,854,607 shares of its common stock to Fosun Pharma. Based on Schedule 13F-HR filed with the SEC on February 2, 2018, Fosun Pharma has sole voting and dispositive power over 2,854,607 shares. On December 11, 2019, the Company issued an additional 52,520 shares directly to Fosun for services of a former Director. On April 12, 2021, the Company issued an additional 711 shares directly to Fosun for services of a former Director On January 7, 2022 , the Company issued an additional 9,558 shares directly to Fosun for services of a former Director. On January 21, 2022, the Company issued an additional 25,000 shares directly to Fosun for options exercised related to the services of a former Director. Total shares outstanding for which Fosun Pharma has sole voting and disposition power is 2,942,126. Shanghai Fosun Pharmaceutical (Group) Co., Ltd lists its address as No. 268 South Zhongshan Road, Shanghai 200010, P.R. China.

|

| 4) | Based on Schedule 13F-HR filed with the SEC on February 14,2023, and Schedule 13D filed with the SEC on June 12, 2017. Includes 2,473,386 shares beneficially owned by Wynnefield Partners Small Cap Value, L.P., Wynnefield Partners Small Cap Value, L.P. I, Wynnefield Small Cap Value Offshore Fund, Ltd., Wynnefield Capital, Inc. Profit Sharing & Money Purchase Plan, Wynnefield Capital Management, LLC, and Wynnefield Capital, Inc. Mr. Nelson Obus and Mr. Joshua Landes exercise voting and investment control over such shares and may be deemed to beneficially own these shares. Messrs. Obus and Landes, however, disclaim any beneficial ownership of these shares. In its Schedule 13D Wynnefield Capital, Inc. lists its address as 450 Seventh Avenue, Suite 509, New York, New York 10123.

|

| 5) | Based on Schedule 13G filed with the SEC on February 7, 2022, and Schedule 13D/A filed with the SEC on August 28, 2014, includes shares purchased by Prescott Group Small Cap, L.P. and Prescott Group Aggressive Small Cap II, L.P. (collectively, the “Small Cap Funds”) through the account of Prescott Group Aggressive Small Cap Master Fund, G.P. (“Prescott Master Fund”), of which the Small Cap Funds are general partners. As general partner of the Small Cap Funds, Prescott Group Capital Management, L.L.C. (“Prescott Capital”) may be deemed to beneficially own these shares. As the principal of Prescott Capital, Mr. Phil Frohlich may also be deemed to beneficially own these shares held by Prescott Master Fund. Each of Prescott Capital and Mr. Frohlich, however, disclaims beneficial ownership of these shares. Prescott Capital and Mr. Frohlich have the sole voting and dispositive power over these shares. In its Schedule 13G, Prescott Group Capital Management, LLC lists its address as 1924 South Utica, Suite 1120, Tulsa, Oklahoma 74104.

|

| 6) | Based on Schedule 13G/A filed with the SEC on February 13, 2023, Paradigm Capital Management, Inc. has sole voting and dispositive power over 1,157,296 shares. In its Schedule 13G/A, Paradigm Capital Management, Inc. lists its address as 9 Elk Street, Albany, New York 12207.

|

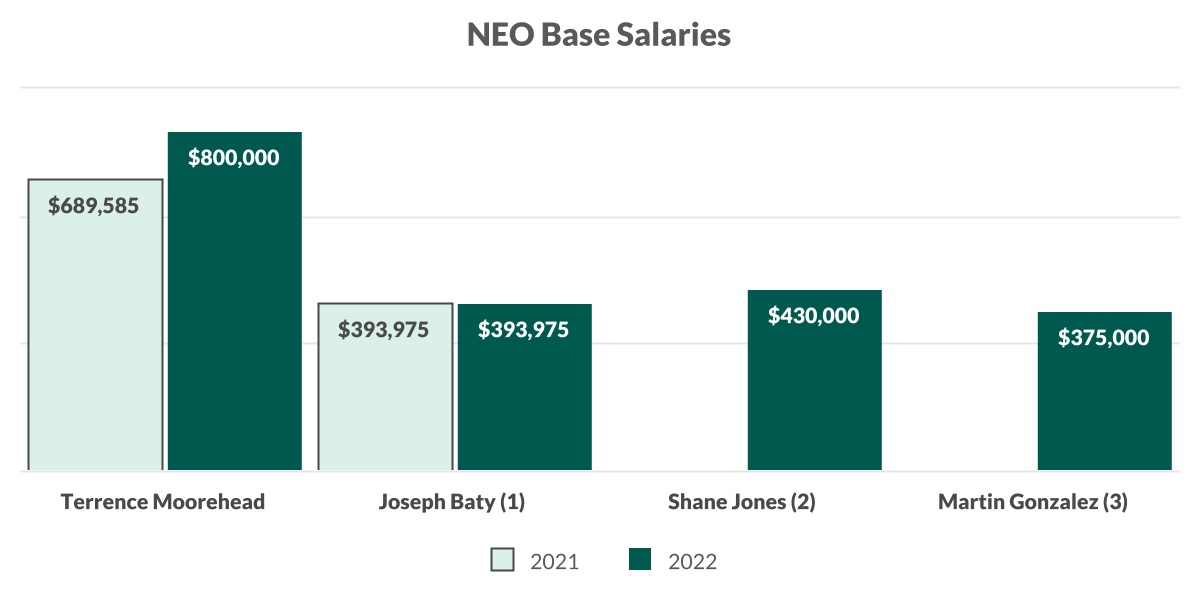

| 7) | Includes vested awards for 31,933 shares of Common Stock within 60 days of February 22, 2023, and 340,909 shares that Mr. Moorehead holds directly.

|

| 8) | Includes options exercisable for 25,000 shares and vested awards for 17,348 shares of Common Stock within 60 days of February 22, 2023, and 30,488 shares that Ms. Springer holds directly.

|

| 9) | Includes options exercisable for 25,000 shares and vested awards for 17,348 shares of Common Stock within 60 days of February 22, 2023, and 22,860 shares that Mr. Teets holds directly.

|

| 10) | Includes options exercisable for 25,000 shares and vested awards for 17,348 shares of Common Stock within 60 days of February 22, 2023, and 11,559 shares that Mr. Straus holds directly.

|

| 11) | Includes options exercisable for 25,000 shares and vested awards for 17,348 shares of Common Stock within 60 days of February 22, 2023, and 6,174 shares that Mr. Moss holds directly.

|

| 12) | Includes vested awards for14,060 shares of Common Stock within 60 days of February 22, 2023.

|

| 13) | Includes vested awards for 6,960 shares of Common Stock within 60 days of February 22, 2023.

|

| 14) | Includes vested awards for 6,820 shares of Common Stock within 60 days of February 22, 2023.

|

| 15) | Includes vested awards for 6,820 shares of Common Stock within 60 days of February 22, 2023.

|

| 16) | Mr. Jones had no awards vesting within 60 days of February 22, 2023 or shares held directly.

|

| 17) | Mr. Gonzalez had no awards vesting within 60 days of February 22, 2023 or shares held directly.

|

| 18) | Includes options exercisable for 137,361 shares and vested awards for 167,654 shares of Common Stock within 60 days of February 22, 2023, and 598,202 shares that the directors and executive officers hold directly or may be deemed to be beneficially owned.

|