FOR IMMEDIATE RELEASE

NATURE’S SUNSHINE PRODUCTS REPORTS THIRD QUARTER 2016 FINANCIAL RESULTS

| |

• | Net sales revenue of $85.4 million was up 7.4% year-over-year |

| |

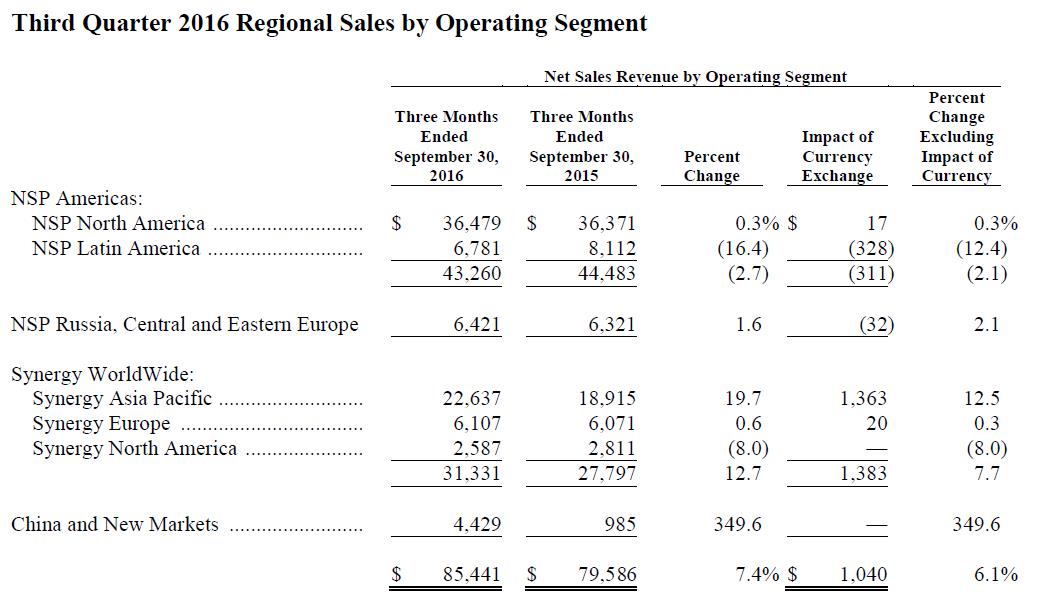

• | Synergy growth of 12.7% driven by 19.7% growth in Synergy Asia Pacific |

| |

• | Earnings from continuing operations of $0.22 per diluted common share |

| |

• | Board of Directors approved a $0.10 per share quarterly cash dividend |

LEHI, Utah, November 8, 2016 - Nature’s Sunshine Products, Inc. (NASDAQ: NATR), a leading natural health and wellness company engaged in the manufacture and direct selling of nutritional and personal care products, today reported its financial results for the third quarter ended September 30, 2016.

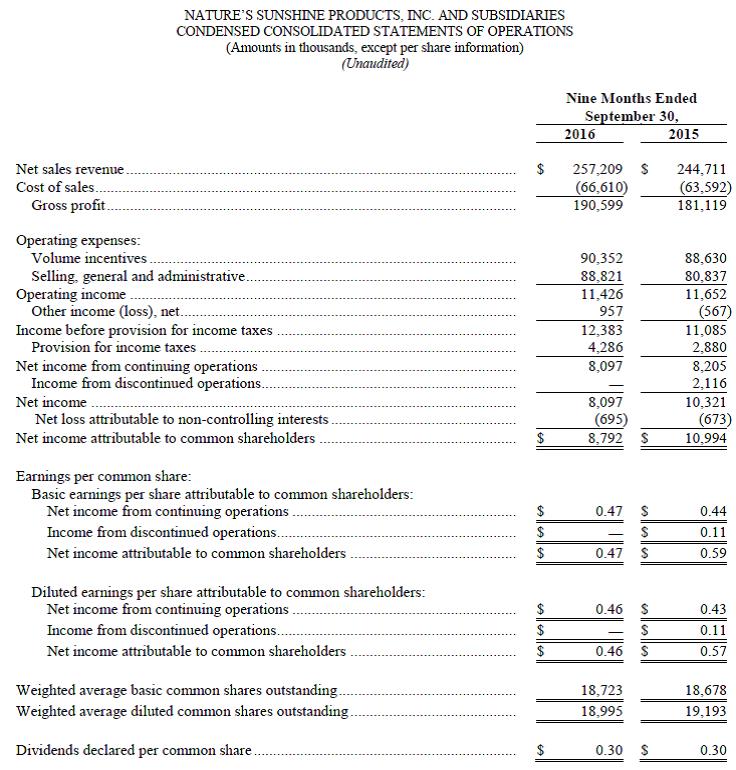

Third Quarter 2016 Financial Highlights

| |

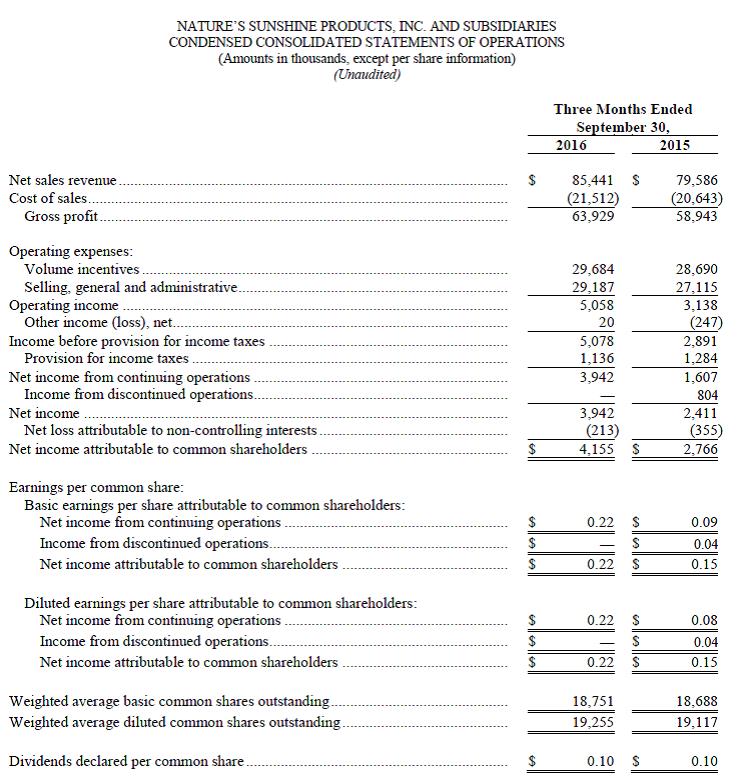

• | Net sales revenue of $85.4 million increased 7.4% compared to $79.6 million in the third quarter of 2015. On a local currency basis, net sales revenue increased 6.1% compared to the third quarter of 2015. Synergy Asia Pacific delivered 19.7% growth (12.5% in local currency) as compared to the third quarter of 2015. The quarter included incremental net sales revenue of $3.7 million related to China pre-opening product sales through Hong Kong. Net sales revenue was positively impacted by $0.9 million of favorable foreign currency exchange rate fluctuations, offset by a $1.0 million decline in net sales in the NSP Americas segment from Latin America. |

| |

• | Net income from continuing operations was $3.9 million, or $0.22 per diluted common share, compared to $1.6 million, or $0.08 per diluted common share, in the third quarter of 2015. |

| |

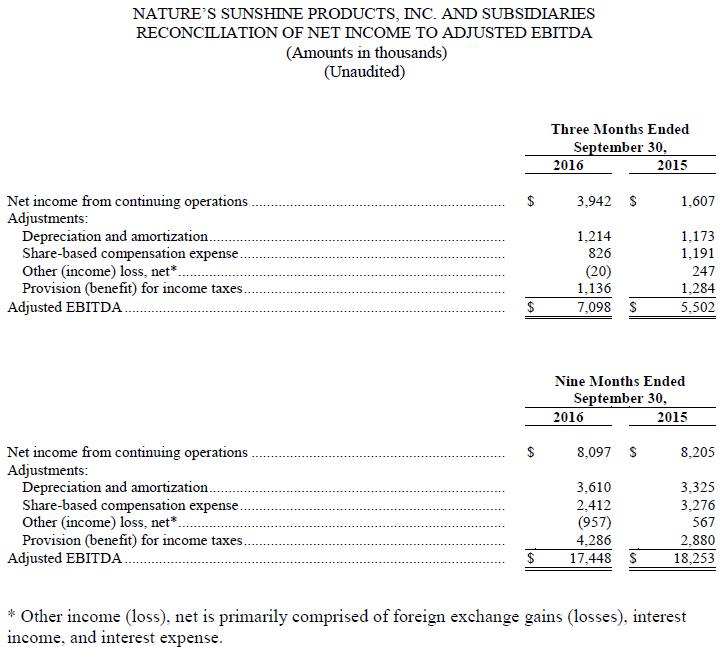

• | Adjusted EBITDA was $7.1 million, compared to $5.5 million in the third quarter of 2015. Adjusted EBITDA, which is a non-GAAP financial measure, is defined here as net income from continuing operations before taxes, depreciation, amortization and other income adjusted to exclude share-based compensation expense. |

First 9 Months of 2016 Financial Highlights

| |

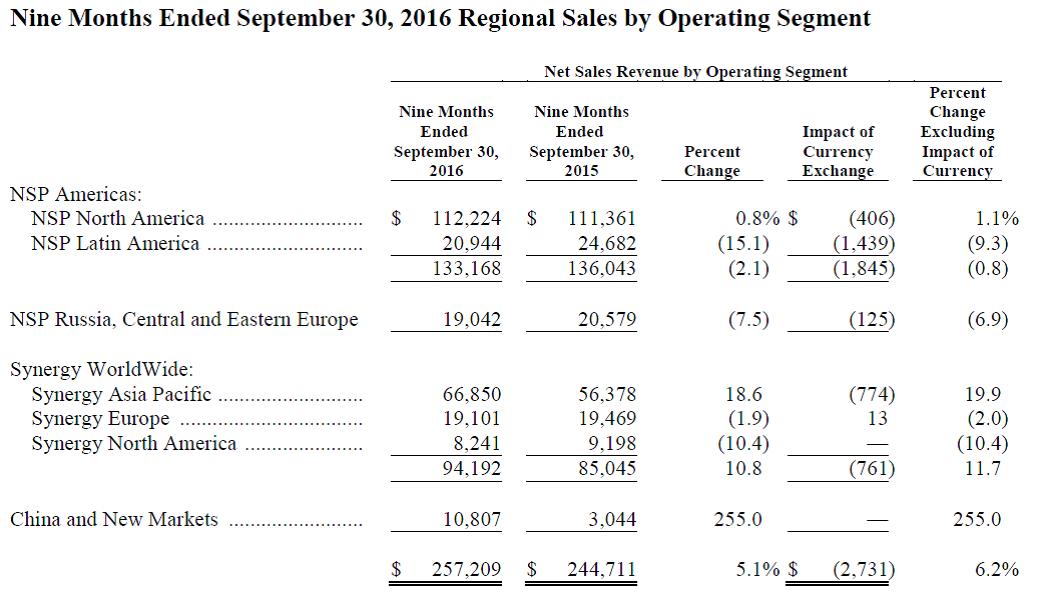

• | Net sales revenue of $257.2 million increased 5.1%, compared to $244.7 million in the first nine months of 2015. On a local currency basis, net sales revenue increased 6.2% compared to the first nine months of 2015. Net sales revenue growth, adjusted for foreign currency fluctuations, was largely driven by a $11.2 million, or 19.9% increase in the Synergy Asia Pacific region and an incremental net sales revenue increase of $8.1 million related to China pre-opening sales through Hong Kong, when compared to the first nine months of 2015. Net sales revenue was negatively impacted by a $2.3 million decline in NSP America sales from Latin America and a $1.4 million decline in net sales in the NSP Russia, Central and Eastern Europe segment. Additionally, net sales revenue was negatively impacted by $2.7 million of unfavorable foreign currency exchange rate fluctuations |

| |

• | Net income from continuing operations was $8.1 million, or $0.46 per diluted common share, compared to $8.2 million, or $0.43 per diluted common share, in the first nine months of 2015. |

Earnings per diluted common share for the first nine months of 2016, were impacted by several factors including: the Company’s investment in China of approximately $0.22 per share.

| |

• | Adjusted EBITDA was $17.4 million compared to $18.3 million in the first nine months of 2015. |

Management Commentary

“During the third quarter, our global growth trends continued and we made good progress with our key product and new market initiatives,” commented Gregory L. Probert, Chairman and Chief Executive Officer. “We achieved our 9th consecutive quarter of growth in both NSP United States and NSP Canada and continue to focus on the expansion of our patent-pending IN.FORM program. Synergy WorldWide once again delivered strong results, led by double-digit growth at Synergy Asia Pacific and further improvements in Synergy Europe. The recent launch of Elite Health in Europe, to be followed by further introductions in Asia in coming quarters, positions us well for further growth across our key Synergy WorldWide markets.”

Mr. Probert continued, “Development of our new market opportunity in China continues as we build the infrastructure in anticipation of our direct selling license being issued. Our product innovations and new market investments have us well-positioned for a strong finish to 2016 with the foundation for future growth.”

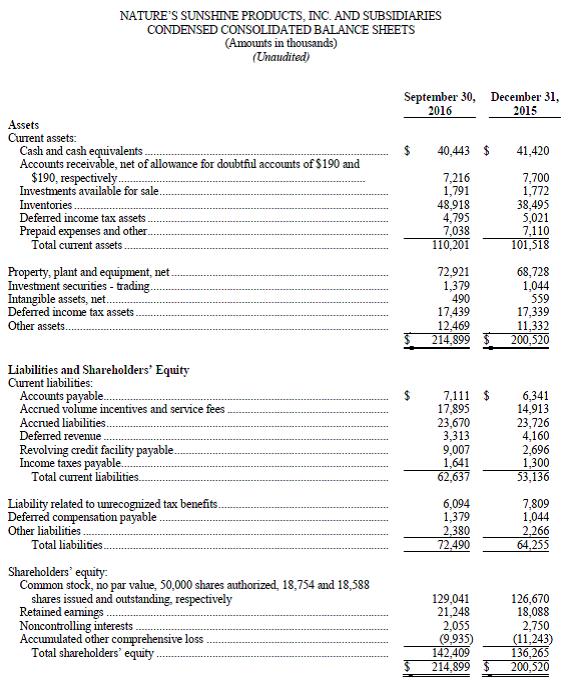

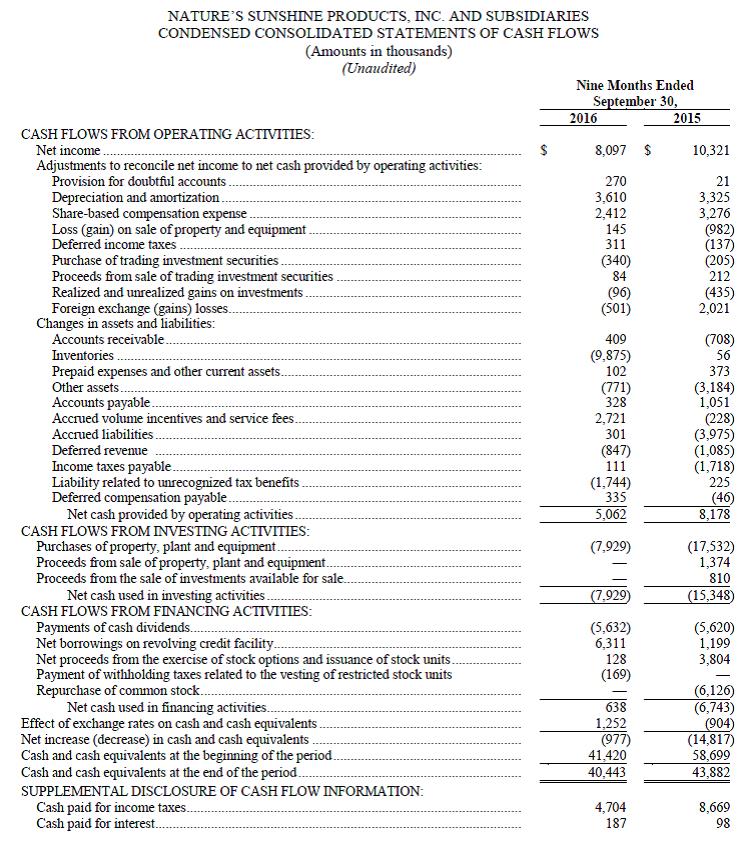

Cash Flow and Balance Sheet Highlights

| |

• | Net cash provided by operating activities was $5.1 million for the nine months ended September 30, 2016, as compared to $8.2 million provided by operating activities for the nine months ended September 30, 2015. |

| |

• | Total assets on September 30, 2016 were $214.9 million, compared to $200.5 million on December 31, 2015. |

| |

• | The Company’s Board of Directors approved a quarterly cash dividend of $0.10 per share, payable on December 5, 2016, to shareholders of record as of the close of business on November 23, 2016. Dividend payments were $5.6 million during the first nine months of 2016. |

Conference Call

Nature’s Sunshine Products will host a conference call to discuss its third quarter 2016 results on November 8, 2016 at 4:30 PM Eastern Time. The toll-free dial-in number for callers in the U.S. and

Canada is 1-877-407-0789, conference ID: 13648794. International callers can dial 1-201-689-8562, conference ID: 13648794. A replay will be available from November 8, 2016 at 7:30 PM Eastern Time through November 22, 2016 at 11:59 PM Eastern Time by dialing 1-877-870-5176 (U.S. and Canada) or 1-858-384-5517 (International), replay PIN: 13648794. The call will also be webcast live and will be available on the Investors section of Nature’s Sunshine Products’ website at www.naturessunshine.com for 90 days.

About Nature’s Sunshine Products

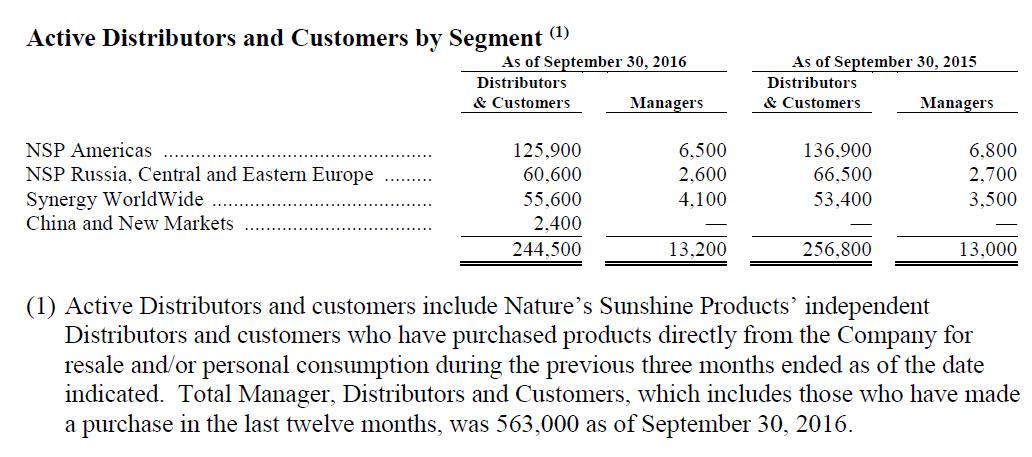

Nature’s Sunshine Products (NASDAQ: NATR), a leading natural health and wellness company, markets and distributes nutritional and personal care products through a global direct sales force of over 560,000 independent Managers, Distributors and customers in more than 40 countries. Nature’s Sunshine manufactures most of its products through its own state-of-the-art facilities to ensure its products continue to set the standard for the highest quality, safety and efficacy on the market today. The Company has four reportable business segments that are divided based on the characteristics of their Distributor base, similarities in compensation plans, as well as the internal organization of NSP’s officers and their responsibilities (NSP Americas; NSP Russia, Central and Eastern Europe; Synergy WorldWide; and China and New Markets). The Company also supports health and wellness for children around the world through its partnership with the Sunshine Heroes Foundation. Additional information about the Company can be obtained at its website, www.naturessunshine.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements regarding the Company’s future business expectations, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may include, but are not limited to, statements relating to the Company’s objectives, plans and strategies. All statements (other than statements of historical fact) that address activities, events or developments that the Company intends, expects, projects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions, and are based on assumptions and assessments made by management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, including the following.

| |

• | any negative consequences resulting from the economy, including the availability of liquidity to the Company, its independent distributors and its suppliers or the willingness of its customers to purchase products; |

| |

• | its relationship with, and its inability to influence the actions of, its independent distributors, and other third parties with whom it does business; |

| |

• | improper activity by its employees or independent distributors; |

| |

• | negative publicity related to its products, ingredients, or direct selling organization and the nutritional supplement industry; |

| |

• | changing consumer preferences and demands; |

| |

• | its reliance upon, or the loss or departure of any member of, its senior management team, which could negatively impact its distributor relations and operating results; |

| |

• | increased state and federal regulatory scrutiny of the nutritional supplement industry, including, but not limited to targeting of ingredients, testing methodology and product claims; |

| |

• | the competitive nature of its business and the nutritional supplement industry; |

| |

• | regulatory matters governing its products, ingredients, the nutritional supplement industry, its direct selling program, or the direct selling market in which it operates; |

| |

• | legal challenges to its direct selling program or to the classification of its independent distributors; |

| |

• | a recent settlement between the Federal Trade Commission and a multilevel marketing company that may have implications for the direct selling industry and the Company; |

| |

• | risks associated with operating internationally and the effect of economic factors, including foreign exchange, inflation, disruptions or conflicts with the its third party importers, governmental sanctions, ongoing Ukraine and Russia political conflict, pricing and currency devaluation risks, especially in countries such as Ukraine, Russia and Belarus; |

| |

• | uncertainties relating to the application of transfer pricing, duties, value-added taxes, and other tax regulations, and changes thereto; |

| |

• | its dependence on increased penetration of existing markets; |

| |

• | cyber security threats and exposure to data loss; |

| |

• | its reliance on its information technology infrastructure; |

| |

• | the sufficiency of trademarks and other intellectual property rights; |

| |

• | changes in tax laws, treaties or regulations, or their interpretation; |

| |

• | taxation relating to its independent distributors; |

| |

• | product liability claims; |

| |

• | the full implementation of its joint venture for operations in China with Fosun Industrial Co., Ltd., as well as the legal complexities, unique regulatory environment and challenges of doing business in China generally; |

| |

• | its inability to register products for sale in Mainland China and difficulty or increased cost of importing products into Mainland China; |

| |

• | managing rapid growth in China; and |

| |

• | the slowing of the Chinese economy. |

These and other risks and uncertainties that could cause actual results to differ from predicted results are more fully detailed under the caption “Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 14, 2016 and in subsequent Quarterly Reports filed with the Securities and Exchange Commission during the current fiscal year.

All forward-looking statements speak only as of the date of this press release and are expressly qualified in their entirety by the cautionary statements included in or incorporated by reference into this press release. Except as is required by law, the Company expressly disclaims any obligation to publicly release any revisions to forward-looking statements to reflect events after the date of this press release.

Non-GAAP Financial Measures

The Company has included information which has not been prepared in accordance with generally accepted accounting principles (GAAP), such as information concerning Adjusted EBITDA and net sales excluding the impact of foreign currency exchange fluctuations. Management utilizes the non-GAAP measure Adjusted EBITDA in the evaluation of its operations and believes that this measure is a useful indicator of the Company’s ability to fund its business. This non-GAAP financial measure should not be considered as an alternative to, or more meaningful than, U.S. GAAP net income as an indicator of the Company’s operating performance. Moreover, Adjusted EBITDA, as presented by the Company, may not be comparable to similarly titled measures reported by other companies.

In addition, the Company believes presenting the impact of foreign currency fluctuations is useful to investors because it allows a more meaningful comparison of net sales of its foreign operations from period to period. Net sales excluding the impact of foreign currency fluctuations should not be considered in isolation or as an alternative to net sales in U.S. dollar measures that reflect current period exchange rates, or to other financial measures calculated and presented in accordance with U.S. GAAP.

Other companies may use the same or similarly named measures, but exclude different items, which may not provide investors with a comparable view of Nature’s Sunshine Products’ performance in relation to other companies. The Company has included a reconciliation of Adjusted EBITDA to net income, the most comparable GAAP measure, in the attached financial tables.

Contacts:

Stephen M. Bunker

Chief Financial Officer

Nature’s Sunshine Products, Inc.

Lehi, Utah 84043

(801) 341-7303

investorrelations@natr.com

Scott Van Winkle

Managing Director

ICR

(617) 956-6736