UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

Nature's Sunshine Products, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

NATURE'S SUNSHINE PRODUCTS, INC.

75 East 1700 South

Provo, UT 84606

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Friday, May 27, 2005

To Our Stockholders:

You are cordially invited to attend the 2005 Annual Meeting of Stockholders of Nature's Sunshine Products, Inc., a Utah corporation (the "Company"). The Annual Meeting will be held at the Company's corporate offices at 75 East 1700 South, Provo, Utah 84606, on Friday, May 27, 2005, at 10:00 a.m., local time, for the following purposes:

Our Board of Directors has fixed the close of business on April 11, 2005, as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting, and only stockholders of record at such date will be so entitled to notice and vote.

Please sign and date the enclosed Proxy and return it promptly in the enclosed postage-paid envelope whether or not you expect to attend the meeting. You may revoke your Proxy and vote in person if you decide to attend the meeting.

| Dated: April 20, 2005 | By Order of the Board of Directors, |

/s/ Douglas Faggioli |

|

DOUGLAS FAGGIOLI President, Chief Executive Officer, Director |

YOUR VOTE IS IMPORTANT.

PLEASE FILL IN DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED POSTAGE PAID ENVELOPE. A PROXY IS REVOCABLE AT ANY TIME PRIOR TO THE VOTING OF THE PROXY, BY WRITTEN NOTICE TO THE SECRETARY OF THE COMPANY OR BY VOTING IN PERSON AT THE MEETING.

NATURE'S SUNSHINE PRODUCTS, INC.

PROXY STATEMENT—ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors of Nature's Sunshine Products, Inc. for use at our Annual Meeting of Stockholders to be held at our corporate offices at 75 East 1700 South, Provo, Utah, on Friday, May 27, 2005 at 10:00 a.m., Mountain Time. Stockholders will consider and vote upon the proposals described herein and referred to in the Notice of the Meeting accompanying this Proxy Statement. This Proxy Statement and the enclosed proxy are first being sent to stockholders on or about April 20, 2005.

We are sending these proxy materials to all of our stockholders of record on April 11, 2005 (the "Record Date"). Only stockholders who owned shares of our common stock at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. We use several abbreviations in this Proxy Statement. We may refer to our company as "we," "us" or "our company" or the "Company." The term "Annual Meeting" means our 2005 Annual Meeting of Stockholders.

QUESTIONS AND ANSWERS ABOUT OUR 2005 ANNUAL MEETING

AND THIS PROXY STATEMENT

independent accountants for the fiscal year ending on December 31, 2005. These proposals are described more fully below in these proxy materials. As of the date of this Proxy Statement, the only business that our Board of Directors intends to present or knows of that others will present at the Annual Meeting is as set forth in this Proxy Statement. If any other matter or matters are properly brought before the Annual Meeting, it is the intention of the persons holding proxies to vote the shares they represent in accordance with their best judgment.

2

considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in your name, but if you wish to vote in person at the Annual Meeting, you must bring with you to the meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

3

4

PRINCIPAL HOLDERS OF COMMON STOCK

The following table sets forth information as of March 18, 2005, with respect to the beneficial ownership of our common stock by (i) each person who, to our knowledge, is the beneficial owner of more than 5 percent of our outstanding common stock, (ii) each director and nominee for director, (iii) each of the executive officers named in the Summary Compensation Table under "Executive Compensation", and all or our executive officers and directors as a group.

| Beneficial Owner |

Number of Shares Beneficially Owned(1) |

Percent of Class(2) |

|||

|---|---|---|---|---|---|

| Pauline Hughes Francis 311 East Canal Road Salem, UT 84653 |

2,106,531 | (3) | 13.9 | % | |

Kristine F. Hughes Eugene L. Hughes 75 East 1700 South Provo, UT 84606 |

1,641,154 |

(4) |

10.7 |

% |

|

Barclays Global Investors 45 Fremont Street San Francisco, CA 94105 |

910,247 |

(5) |

6.0 |

% |

|

First Wilshire Securities Management, Inc. 600 South Lake Street, Suite 100 Pasadena, CA 91106-3955 |

867,501 |

(6) |

5.8 |

% |

|

5

Douglas Faggioli 75 East 1700 South Provo, UT 84606 |

253,541 |

(7) |

1.7 |

% |

|

John R. DeWyze 75 East 1700 South Provo, UT 84606 |

64,918 |

(8) |

* |

||

Craig D. Huff 75 East 1700 South Provo, UT 84606 |

53,807 |

(9) |

* |

||

Daren G. Hogge 75 East 1700 South Provo, UT 84606 |

13,388 |

(10) |

* |

||

Franz L. Cristiani 75 East 1700 South Provo, UT 84606 |

5,000 |

(11) |

* |

||

Richard G. Hinckley 75 East 1700 South Provo, UT 84606 |

0 |

* |

|||

Dale G. Lee 75 East 1700 South Provo, UT 84606 |

104,055 |

(12) |

* |

||

All executive officers and directors As a group (9 persons) |

4,138,339 |

(13) |

26.4 |

% |

6

Certain of our officers and directors own de minimus amounts of the outstanding equity securities of our wholly owned subsidiaries to satisfy regulatory requirements.

7

PROPOSAL 1—ELECTION OF DIRECTORS

Under our Restated Articles of Incorporation, directors are divided into three classes, each class to consist, as nearly as possible, of one-third of the number of directors then constituting the entire Board of Directors. Each year, one class of directors is elected, each director to serve a term of three years. All of the directors were elected for staggered terms at the last three annual meetings.

At the Annual Meeting, two Class III directors are to be elected to serve for a term of three years or until a successor for such director is elected and qualified, or until the death, resignation, or removal of such director. It is intended that the proxies will be voted for the two nominees named below for election to our Board of Directors unless authority to vote for any such nominee is withheld. Each of the nominees is currently serving as one of our directors. Each person nominated for election has agreed to serve if elected, and the Board of Directors has no reason to believe that any nominee will be unavailable or will decline to serve. In the event, however, that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the current Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them "FOR" the nominees named below. The two candidates receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected as directors of our company.

Certain information concerning the two nominees to the Board of Directors and directors whose terms will continue after the Annual Meeting is set forth below. Biographical information regarding the nominees is set for below under "EXECUTIVE OFFICERS AND DIRECTORS."

| Name |

Age |

Company Position Held |

Served as Director Since |

Class and Year Term Will Expire |

||||

|---|---|---|---|---|---|---|---|---|

| NOMINEES | ||||||||

Kristine F. Hughes |

66 |

Chairperson of the Board and Director |

1980 |

Class III 2005 |

||||

| Franz L. Cristiani | 63 | Director | 2004 | Class III 2005 | ||||

DIRECTORS WHOSE TERMS ARE CONTINUING |

||||||||

Pauline Hughes Francis |

64 |

Director |

1988 |

Class I 2006 |

||||

| Douglas Faggioli | 50 | President, Chief Executive Officer, Director | 1997 | Class I 2006 | ||||

| Richard G. Hinckley | 63 | Director | 1999 | Class II 2007 | ||||

| Eugene L Hughes | 74 | Founder and Director | 1980 | Class II 2007 | ||||

8

On May 28, 2004, the Board, as authorized by the Company's By-Laws, elected Franz L. Cristiani to the Board of Directors. Mr. Cristiani, who is standing for election by the stockholders for the first time, was recommended by the Chief Executive Officer of the Company. Mr. Cristiani was nominated based upon his extensive experience in the financial industry and his integrity, judgment and leadership ability demonstrated by that experience, as well as his independence. Mrs. Hughes is standing for re-election based upon the judgment, skill and dedication she has previously demonstrated as a Board member and Chairperson.

Affirmative Determinations Regarding Director Independence

The Board of Directors has determined each of the following directors to be an "independent director" as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers (the "NASD"):

Franz

L. Cristiani

Richard G. Hinckley

Pauline Hughes Francis

Kristine F. Hughes

In this Proxy Statement, these four directors are referred to individually as an "Independent Director" and collectively as the "Independent Directors". During 2004, the Independent Directors met four times in executive session. The Independent Directors meet in executive sessions at which only Independent Directors were present in conjunction with each scheduled meeting of the Board of Directors. The Board determined that Eugene L Hughes is not independent because he serves as a non-executive employee of the Company.

Meetings and Committees of the Board of Directors

There were five meetings of the Board of Directors held during 2004. All directors attended at least 75 percent of the meetings of the Board and Committees of the Board on which they served.

The Board of Directors has formed the following committees:

The Compensation Committee. The Compensation Committee, which held three meetings during 2004, reviews compensation policies applicable to officers and key employees and recommends to the Board of Directors the compensation to be paid to our Chief Executive Officer and recommends to the Board, based on consultation with the Chief Executive Officer, compensation to be paid to the other executive officers. The Compensation Committee also administers or supervises our various stock option and incentive compensation plans. The Compensation Committee has not adopted a written charter. The members of Compensation Committee are Pauline Hughes Francis (Chairperson), Kristine F. Hughes and Richard G. Hinckley, each of whom is an Independent Director.

9

The Audit Committee. The Audit Committee, which held four meetings during 2004, oversees our financial statements, preparation process and related compliance matters and performance of the internal audit function, is responsible for engagement and oversight of our independent registered public accounting firm and reviews the adequacy and effectiveness of our internal control system and procedures. The Audit Committee acts pursuant to a written charter adopted by the Board. A copy of the Audit Committee Charter was attached as Appendix A to our 2004 Annual Meeting Proxy Statement dated April 9, 2004, which was filed pursuant to Section 14(a) of the Securities Exchange Act of 1934.

The members of the Audit Committee are Richard G. Hinckley (Chairman), Franz L. Cristiani, Kristine F. Hughes and Pauline Hughes Francis, each of whom is an Independent Director and independent for the purposes of the regulations promulgated by the SEC. Our Board of Directors has determined that Richard G. Hinckley and Franz L. Cristiani are audit committee financial experts, as that term is defined in Item 401(h) of Regulation S-K promulgated by the Securities and Exchange Commission. Both Kristine Hughes and Pauline Hughes Francis fall outside the SEC safe harbor providing that a person will not be deemed an affiliate for purposes of determining audit committee member independence if he or she beneficially owns 10 percent or less of an issuer's voting stock. As of April 11, 2005, Mrs. Hughes beneficially owned 10.7 percent of the Company's common stock and Mrs. Francis beneficially owned 13.9 percent of the Company's common stock. The Board has determined that both Mrs. Hughes and Mrs. Francis are independent for the purpose of the SEC regulations and the NASD Marketplace Rules.

The Nominating Committee. The Nominating Committee, which held three meetings during 2004, makes recommendations to the Board of Directors about the size of the Board or any committee thereof, identifies and recommends candidates for the Board and committee membership, evaluates nominations received from stockholders, determines the compensation and benefits of all directors on the Board and develops and recommends to the Board corporate governance principles applicable to our company. The Nominating Committee has not adopted a written charter.

The members of the Nominating Committee are Kristine F. Hughes, Pauline Hughes Francis and Richard G. Hinckley, each of whom is an Independent Director.

The Company's Director Nomination Process

The Board selects the Director nominees to stand for election at the Company's annual meetings of stockholders and to fill vacancies occurring on the Board, based on the recommendations of the Nominating Committee. In recommending nominees to serve as Directors, the Nominating Committee will examine each Director nominee, including persons nominated by stockholders, on a case-by-case basis regardless of who recommended the nominee and take into account all factors it considers appropriate. However, the Nominating

10

Committee believes the following minimum qualifications must be met by a potential Director nominee to be recommended to the Board:

Recommendations for consideration by the Nominating Committee, including recommendations from stockholders of the Company, should be sent to the Board of Directors, care of the Secretary of the Company, at Nature's Sunshine Products, Inc., 75 East 1700 South, Provo, Utah 84606, in writing together with appropriate biographical information concerning each proposed nominee. Recommendations for nominees to be elected at the 2006 Annual Meeting of Stockholders must be received by December 31, 2005. See also the section dealing with "Stockholder Proposals," below.

Communications with Directors

We have not in the past adopted a formal process for stockholder communications with the Board of Directors. Nevertheless, every effort has been made to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. We believe our responsiveness to stockholder communications to the Board has been excellent. Nevertheless, during the upcoming year the Board or the Nominating Committee of the Board will give full consideration to the adoption of a formal process for stockholder communications with the Board and, if adopted, publish it promptly and post it to our website.

Compensation of Directors

The following table sets out fees paid to non-employee directors of our Company for their services as Board members during Fiscal 2004 and fees to be paid in 2005:

| |

2004 |

2005 |

||||

|---|---|---|---|---|---|---|

| Kristine Hughes (Chairperson) | $ | 129,792 | $ | 132,292 | ||

| Pauline Hughes Francis | $ | 46,440 | $ | 49,762 | ||

| Franz L. Cristiani | $ | 30,000 | $ | 31,500 | ||

| Richard G. Hinckley | $ | 30,000 | $ | 35,500 | ||

11

Non-employee directors also receive health and life insurance coverage. Board members have the option to receive life insurance coverage in the amount of $500,000. Currently only Kristine Hughes and Pauline Hughes Francis have life insurance coverage and in 2004, we paid premiums of $1,690 for Pauline Hughes Francis and did not pay any premiums for Kristine Hughes. We do not pay any fees for attendance at Committee meetings. Board members who are also employees of our Company do not receive any directors' fees. Mr. Hughes is a non-executive employee of the Company and received a salary of $190,000 for his services as an employee in 2004.

EXECUTIVE OFFICERS AND DIRECTORS

Our executive officers and directors are:

| Name |

Position |

Age |

||

|---|---|---|---|---|

| Douglas Faggioli | President, Chief Executive Officer and Director | 50 | ||

| Kristine F. Hughes | Chairperson of the Board and Director | 66 | ||

| Eugene L Hughes | Founder and Director | 74 | ||

| Pauline Hughes Francis | Director | 64 | ||

| Richard G. Hinckley | Director | 63 | ||

| Franz L. Cristiani | Director | 63 | ||

| Craig D. Huff | Executive Vice President, Chief Financial Officer, Vice President—Finance and Treasurer | 49 | ||

| Daren G. Hogge | Executive Vice President | 43 | ||

| John R. DeWyze | Executive Vice President, Vice President—Operations | 48 |

Certain information regarding the business experience of the executive officers and directors is set forth below.

DOUGLAS FAGGIOLI. Mr. Faggioli is the President, Chief Executive Officer and a Director of our company. Prior to his appointment as president and CEO in November 2003, Mr. Faggioli was Executive Vice President, Chief Operating Officer and a Director of our company. He began his employment with us in 1983 and has served as one of our officers since 1989. He is a Certified Public Accountant.

KRISTINE F. HUGHES. Mrs. Hughes is our Chairperson of the Board of Directors. She was a co-founder in 1972 of Hughes Development Corporation, a predecessor of our company, and has served as an officer or director of our company and/or its predecessors since 1980. Mrs. Hughes serves on several civic and community boards. She is the wife of Eugene L. Hughes, one of our founders and directors.

12

EUGENE L HUGHES. Mr. Hughes is a founder and a director of our company. He co-founded Hughes Development Corporation, a predecessor of our company, in 1972. He served as an officer or director of our company and/or its predecessors since 1972. Mr. Hughes serves on several community boards. He is the husband of Kristine F. Hughes, our Chairperson.

PAULINE HUGHES FRANCIS. Mrs. Francis has been one of our Directors since 1988. Mrs. Francis was a co-founder in 1972 of Hughes Development Corporation, a predecessor of the company, and has acted as a consultant from time to time to our company and its predecessors.

RICHARD G. HINCKLEY. Mr. Hinckley has served as a Director of our company since 1999. He is a partner of Interior Space Systems, Inc. From 1996 until 2001. Mr. Hinckley served as Director of Corporate Development—Western Region, Nextlink Communications. From 1991 to 1996, he served as a Vice President of Beehive Travel until its merger with Morris Travel where he became the Director of Meetings and Incentives. He also served as president, director and part owner of Park "n Jet, Utah's largest off-airport parking facility. Mr. Hinckley received his MBA degree from Stanford University.

FRANZ L. CRISTIANI. Mr. Cristiani has been a member of the board of directors since 2004. From 1964 until his retirement in 1999, he was with Arthur Andersen, an international public accounting firm, including 23 years as a partner. Since retiring, he has provided consulting services to various companies, served on the board of directors of Accuray, BioMarin Pharmaceutical, MTI Technology and Vitasoy USA, and has served as an adjunct professor at the graduate school of business at the University of San Francisco. He is a Certified Public Accountant.

CRAIG D. HUFF. Mr. Huff is our Executive Vice President, Chief Financial Officer, Vice President of Finance and Treasurer. He began his employment with us in 1982 and has served as an officer of our company since 1998. He is a Certified Public Accountant.

DAREN G. HOGGE. Mr. Hogge is Executive Vice President of Synergy. He began his employment with us in 1993, and has served as an officer of our company since 1997.

JOHN R. DEWYZE. Mr. DeWyze is Executive Vice President and Vice President of Operations of our company. He began his employment with us in 1995. From 1982 to 1995, Mr. DeWyze was employed by Bristol-Myers Squibb. He has served as one of our officers since 1997.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of Forms 3, 4 and 5 and amendments thereto as well as written representations provided to us by our executive officers, directors and 10 percent stockholders, we are unaware of any such persons failing to file on a timely basis any reports required by Section 16(a) of the Exchange Act during 2004.

13

Code of Ethics

We have adopted a code of ethics that applies to all employees of our company, including our executive officers, employees of our subsidiaries, as well as each member of our Board of Directors. The code of ethics is available at our website at: www.natr.com.

Compensation Summary

The following table sets forth information concerning the cash and non-cash compensation paid or to be paid by us to our Chief Executive Officer and to each of the other executive officers named below, for the three fiscal years ended December 31, 2004.

14

| |

|

|

|

|

Long-Term Compensation |

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

|

||||||||||

| |

Securities Under-Lying Options/SARS (Shares) |

|

||||||||||

| Name and Principal Position |

Year |

Salary ($)(1) |

Bonus ($) |

Other Annual Compensation ($)(2) |

All Other Compensation(3) ($) |

|||||||

| Douglas Faggioli President, Chief Executive Officer |

2004 2003 2002 |

373,732 257,366 258,964 |

315,000 — — |

— — — |

— 2,000 25,000 |

2,391 1,338 1,314 |

||||||

Daren G. Hogge Executive Vice President |

2004 2003 2002 |

211,451 187,371 200,000 |

437,228 237,652 38,000 |

— — — |

— — — |

757 730 734 |

||||||

Craig D. Huff Executive Vice President, Chief Financial Officer, Vice President, Finance |

2004 2003 2002 |

193,729 180,680 181,317 |

356,720 144,308 79,103 |

— — — |

— — 2,000 |

887 846 851 |

||||||

John R. DeWyze Executive Vice President, Vice President—Operations |

2004 2003 2002 |

188,193 164,689 177,000 |

120,066 32,816 24,399 |

— — — |

— — — |

918 878 883 |

||||||

Dale G. Lee(4) Former Executive Vice President, President, U.S. Sales |

2004 2003 2002 |

200,718 179,482 190,756 |

— 25,990 — |

— — — |

50,000 4,000 — |

2,372 2,281 2,301 |

||||||

15

Employment Agreements

We have entered into employment agreements with each of our executive officers. The form of employment agreement is included as an exhibit to our annual report on Form 10-K for the fiscal year ended December 31, 2004. These agreements have one-year terms that renew automatically unless terminated by us or the officer. In the event that we terminate or do not renew an officer's employment without cause (as defined in the agreements) or the officer's employment terminates as a result of death or incapacity, the officer is entitled to receive his base salary for twelve months. The executives agree not to disparage us during the term of the agreement. In addition, under the employment agreement, for a period ending one year after the later of the termination of his employment or the date the last severance payment was paid (or would have been paid but for his breach of the agreement or termination for cause) under the agreement, the officer agrees not to solicit any person under contract with us or any of our customers and not to compete with us in countries where we do business. We can extend this period for up to an additional year if we pay the employee an amount equal to his base salary during this extension. For 2005, our executive officers' base salaries are as follows:

| Officer |

Base Salary |

||

|---|---|---|---|

| Douglas Faggioli | $ | 350,000 | |

| Darren G. Hogge | $ | 198,500 | |

| Craig D. Huff | $ | 184,000 | |

| John R. DeWyze | $ | 181,000 | |

Executive Incentive Plans

We have from time to time adopted incentive plans for key management and/or other employees.

In 1997, the Board of Directors adopted an Incentive Compensation Plan ("Bonus Plan"), which provides for bonuses ranging from 0 percent to 90 percent of base salary for all of our employees depending upon the employee's position with us. Up to 40 percent of the bonus for certain key employees is determined by how well an employee achieves certain specified individual performance objectives, and the balance is determined by how well we achieve certain sales and operating income goals. Payments totaling approximately $1,229,000, $441,000 and $142,000 were made to executive officers for services rendered in 2004, 2003 and 2002, respectively, for this or similar executive incentive plans. Amounts paid, if any, to the officers participating in the Bonus Plan are included in the Summary Compensation Table.

Stock Option Plans

Our 1995 Stock Option Plan, as amended (the "1995 Plan"), authorizes the grant of incentive and non-qualified stock options to officers and key employees. The 1995 Plan currently allows for the granting of a maximum of 4,150,000 shares of our common stock (adjusted for stock splits and dividends).

16

Options issued under the 1995 Plan must have an exercise price at least equal to the fair market value on the date of grant and a term of not more than ten years. Options are generally not transferable and are exercisable in accordance with vesting schedules established by the Compensation Committee (the "Committee") of the Board of Directors administering the Plan. The Committee establishes with respect to each option granted to an employee, and sets forth in the option agreement, the effect of the termination of employment on the rights and benefits thereunder. In the event of certain changes in control of our company, options generally become immediately exercisable.

As of March 18, 2005, there were 1,039,648 shares subject to non-qualified options issued and outstanding under the 1995 Plan and 106,803 shares are available for issuance (as adjusted for stock splits and dividends).

We also have 236,450 shares subject to non-qualified options issued and outstanding, which were granted under stock option plans or arrangements that have been terminated.

Option Grants in Fiscal Year 2004

The following table sets forth a summary of certain non-qualified stock options granted to our named executive officers during 2004.

| |

Number of Shares Underlying Options Granted(1) (Shares) |

|

|

|

Potential Realizable Value at Assumed Annual Rates for Option Term of Stock Price Appreciation |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

% of Total Options Granted to Employees in 2004(2) |

|

|

||||||||||||

| Name |

Exercise Price Per Share |

Expiration Date |

|||||||||||||

| 5% |

10% |

||||||||||||||

| Dale G. Lee(3) | 50,000 | 52.63 | % | $ | 8.50 | 1/09/2010 | $ | 144,541 | $ | 327,913 | |||||

17

The following table and notes provide information about shares of our common stock that were issuable as of December 31, 2004 pursuant to exercise of options under existing equity compensation plans.

| Plan Category |

Number of securities to be issued upon exercise of outstanding options |

Weighted-average exercise price of outstanding options |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 1,206,338 | (1) | $ | 9.02 | 106,803 | (1) | |||

| Equity compensation plans not approved by security holders | 256,450 | (2) | $ | 8.56 | — | ||||

| Total | 1,462,788 | $ | 8.94 | 106,803 | |||||

Option Exercises During 2004 and 2004 Year-end Value Table

The following table sets forth certain information regarding the value of non-qualified stock options held by the named executive officers during 2004 (as adjusted for stock splits and dividends).

2004 Year-end Option Value

| Name |

Shares Acquired on Exercise (#) |

Value Received ($) |

Number of Unexercised Options at December 31, 2004 Exercisable/Unexercisable (#) |

Value of Unexercised In-the-Money Options at December 31, 2004 Exercisable/Unexercised ($) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Douglas Faggioli | 60,000 | 465,000 | 174,390 | / | — | 2,080,391 | / | — | ||||||

| Daren G. Hogge | 91,330 | 706,565 | 10,880 | / | 500 | 123,597 | / | 5,195 | ||||||

| Craig D. Huff | 50,000 | 387,500 | 43,010 | / | — | 538,001 | / | — | ||||||

| John R. DeWyze | 48,750 | 378,774 | 60,320 | / | — | 674,148 | / | — | ||||||

| Dale G. Lee(1) | 36,000 | 312,248 | 71,461 | / | 50,000 | 898,761 | / | 593,000 | ||||||

18

401(k) Plan

We sponsor a qualified deferred compensation plan ("401(k) Plan") under Section 401(k) of the Internal Revenue Code, in which full-time employees may reduce their salaries by up to 15 percent of their compensation limited to a maximum of $13,000 and have the salary reduction amounts contributed to the 401(k) Plan. Such contributions are 100 percent matched by us, up to a maximum of 5 percent of the employee's compensation. Participants are fully vested at all times in their salary reduction contributions and after three years of service are fully vested in matching company contributions. Participants are eligible to receive distribution of vested amounts upon retirement, death or disability, or termination of employment. Contributions by us to the 401(k) Plan were approximately $863,000, $902,000 and $894,000 for 2004, 2003 and 2002, respectively. Amounts contributed for executive officers participating in the 401(k) Plan are included in the Summary Compensation Table above.

Deferred Compensation Plan

Our nonqualified deferred compensation plan, the Supplemental Elective Deferral Plan, is offered to our directors, officers and certain other senior management. Under our Supplemental Elective Deferred Compensation Plan for our executive officers, up to 100 percent of the executive officer's annual salary and bonus (less the officer's share of employment taxes) may be deferred. The deferrals become an obligation owed to the officer by us under the Plan. Participants have several investment options for amounts deferred. Deferred amounts are paid following separation from the Company. Executive officers do not begin to receive deferred amounts until a minimum of six months after separation. Distributions are made over a thirty-six month period. At December 31, 2004 and 2003, the amounts payable under the Plan are valued at the fair market value of the related assets and total $2.0 million and $2.2 million, respectively. Amounts deferred for executive officers participating in the Supplemental Elective Deferred Compensation Plan are included in the Summary Compensation Table above.

19

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The following individuals are immediate family members of the Board of Directors or Executive Officers and are currently employed by the Company.

| Name and Title |

Current Salary |

Relationship |

|||

|---|---|---|---|---|---|

| Kenneth Fugal, Employee Director of Research and Development |

$ | 97,000 | Brother to Kristine Hughes | ||

Kent Hastings, Employee Director of International Compensation Analysis |

90,500 |

Son in law of Eugene and Kristine Hughes |

|||

Larry Hughes, Employee Director of Manufacturing |

90,200 |

Son of Pauline Hughes Francis |

|||

Ryan Finch, Manager of Product Development |

78,700 |

Son in law of Pauline Hughes Francis |

|||

John Hughes, Employee Director of Project Engineering |

71,200 |

Son of Pauline Hughes Francis |

|||

Jeff Hughes, Manager of International DRP |

56,500 |

Son of Pauline Hughes Francis |

|||

Michael Hughes, Group Leader of Utah Distribution Center |

33,200 |

Son of Pauline Hughes Francis |

|||

Craig D. Huff, Chief Financial Officer, during 2004 had a son and a niece employed in the Company's Order Sales department at an hourly wage.

Compensation Committee Interlocks and Insider Participation

The Board of Directors' Compensation Committee is composed of Pauline Hughes Francis, Kristine F. Hughes and Richard G. Hinckley. Mrs. Hughes served as our President and CEO from September 1996 to October 1997.

THE FOLLOWING REPORT OF THE COMPENSATION COMMITTEE AND THE PERFORMANCE GRAPH THAT APPEARS IMMEDIATELY AFTER SUCH REPORT SHALL NOT BE DEEMED TO BE SOLICITING MATERIAL OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO FILED.

20

COMPENSATION COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

To: The Board of Directors

As members of the Compensation Committee (the "Committee"), it is our duty to recommend to the Board of Directors the compensation to be paid to the Company's Chief Executive Officer and to recommend to the Board, based on consultation with the Chief Executive Officer, compensation to be paid to the other executive officers. The Committee also reviews compensation policies applicable to officers and key employees and considers the relationship of corporate performance to that compensation. In addition, we administer the Company's 1995 Stock Option Plan and the Incentive Compensation Plan and supervise management in the administration of the Supplemental Elective Deferred Compensation Plan.

The Committee seeks to grant executive compensation packages that (i) reflect individual accomplishments and contributions to the Company as well as overall Company performance; (ii) align executive's interests with those of the Company's stockholders; and (iii) attract and retain qualified executives who will help the Company meet its goals.

The Committee submits a report to the Board concerning the compensation policies followed by the Committee in recommending compensation for the Company's Chief Executive Officer and other executive officers and the Board approves such compensation. The compensation policy of the Company, which is endorsed by the Committee, is that a substantial portion of the annual compensation of each officer relate to and be contingent upon the performance of the Company, as well as the individual contribution of each officer. The Committee believes the compensation paid to its officers is reasonable in view of the Company's performance and the contribution of the officers to that performance.

In 2004, the Board approved the compensation packages for the Company's Chief Executive Officer and other executive officers that were recommended by the Compensation Committee. The Total Compensation for executive officers in 2004 consisted of base salary and bonus.

Base Salary. In establishing compensation for 2004, the Committee considered a number of factors, including:

The Committee also considered the level of compensation that is necessary to attract, retain and motivate qualified officers. In this regard, the Committee reviewed several third

21

party salary reports and surveys. In 2004, other salaries of executive officers were set using the same factors as set forth above.

Bonus. In 2004, executives received bonuses ranging from 0 percent to 90 percent of their salaries pursuant to the Company's Incentive Compensation Plan (the "Bonus Plan"). Under the Bonus Plan, bonuses are paid based on the officer's performance and the performance of the entire Company. Between 0 percent and 40 percent of the bonuses paid to executive officers were based on the executive achieving certain specified individual performance objectives related to their area of responsibility. The remainder of the bonus amounts were based on the Company obtaining certain sales and operating income goals. In January of 2004, an additional bonus program was approved by the Board for two executive officers, Daren G. Hogge and Craig D. Huff, wherein they could earn additional bonuses based upon the growth in sales revenue and operating income in the Company's Synergy Worldwide segment and the reduction in selling, general and administrative expenses of the Company as compared to sales revenue on a consolidated basis. In February of 2005, Daren G. Hogge was paid $301,257 and Craig D. Huff was paid $235,888 in accordance with this bonus program.

Equity-Based Compensation. All officers and key employees participate in the Company's stock option plans. The Committee believes that stock options have been effective in attracting motivating and retaining key employees. During 2004, the Committee recommended stock options grants in the aggregate amount of 50,000 shares to Dale Lee.

Chief Executive Officer Compensation. In setting the Chief Executive's 2004 base salary, the Committee, applied the factors set forth above. The Chief Executive Officer also received a bonus of $315,000 for 2004 under the Bonus Plan. The bonus amount was based on the Company obtaining certain consolidated sales and operating income goals.

Except for Kristine F. Hughes, no member of the Committee is a former or current officer or employee of the Company or any of its subsidiaries. Mrs. Hughes served as President and CEO of the Company from September 1996 to October 1997.

| COMPENSATION COMMITTEE | |

Dated: April 20, 2005 |

Pauline Hughes Francis, Chairperson Kristine F. Hughes Richard G. Hinckley |

22

CORPORATE STOCK PERFORMANCE

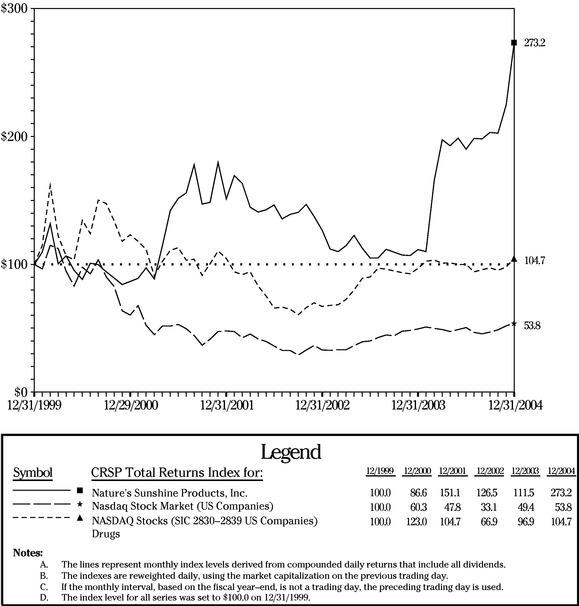

The following graph compares the performance (total return on investment as measured by the change in the year-end stock price plus reinvested dividends) of our common stock ("NATR") with that of the Index for NASDAQ National Stock Market (U.S. companies) and the Index for NASDAQ Stock (SIC 2800-2899) (herbal vitamins companies) for the five years ended December 31, 2004.

Comparison of Five-Year Cumulative Total Returns

Performance Graph for

Nature's Sunshine Products, Inc.

Produced on 03/17/2005 including data to 12/31/2004

23

PROPOSAL 2—RATIFICATION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected KPMG LLP to be our independent registered public accounting firm for the fiscal year ending December 31, 2005. KPMG LLP served as our auditors for the fiscal years ended December 31, 2003 and 2004.

We are asking the stockholders to ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005. The affirmative vote of the holders of a majority of the shares voting on this proposal will be required to ratify the selection of KPMG LLP.

In the event the stockholders fail to ratify the appointment, the Audit Committee will consider it as a direction to select other auditors for the subsequent year. Even if the selection is ratified, the Audit Committee in their discretion may direct the appointment of a different independent auditing firm at any time during the year if it determines that such change would be in the best interest of the Company and its stockholders.

Representatives of KPMG LLP are expected to attend the Annual Meeting and will have an opportunity to make a statement if they desire to do so, and they will be available to answer appropriate questions from stockholders.

The Board of Directors unanimously recommends that our stockholders vote FOR the proposal to ratify the selection of KPMG LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2005.

Audit and Other Fees

The following table presents fees for professional services rendered by KPMG LLP for the audit of our annual financial statements for the fiscal years ended December 31, 2004 and December 31, 2003 and fees billed for other services rendered by KPMG LLP during those periods:

| |

Fiscal 2004 |

Fiscal 2003 |

|||||

|---|---|---|---|---|---|---|---|

| Audit Fees(1) | $ | 821,000 | $ | 332,353 | |||

| Audit-Related Fees(2) | 9,000 | 24,502 | |||||

| Tax Fees(3) | 127,000 | 31,091 | |||||

| All Other Fees | — | — | |||||

| Total | $ | 957,000 | $ | 487,946 | |||

24

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the independence of KPMG and has concluded that it is.

Pre-Approval Policy

The policy of the Audit Committee is to pre-approve all auditing and non-auditing services of the independent registered public accounting firm, subject to de minimus exceptions for other than audit, review, or attest services that are approved by the Audit Committee prior to completion of the audit. Alternatively, the engagement of the independent registered public accounting firm may be entered into pursuant to pre-approved policies and procedures established by the Committee, provided that the policies and procedures are detailed as to the particular services and the Committee is informed of each service.

25

The Audit Committee of Nature's Sunshine Products, Inc., is composed of four independent directors and operates under written charter adopted by the Company's Board of Directors in 2003. The Audit Committee is currently comprised of Richard G. Hinckley (Chairman), Franz L. Cristiani, Pauline Hughes Francis and Kristine F. Hughes. During the period that each member has served on the Audit Committee, each has been "independent" as this term applies to Rule 4200(a)(15) of the National Association of Securities Dealers' ("NASD") and its listing standards.

To: The Board of Directors

We have reviewed and discussed with management the Company's audited consolidated financial statements as of and for the year ended December 31, 2004.

We have discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and letter from the independent registered public accounting firm required by the Independence Standards Board, and have discussed with the auditors the auditors' independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the consolidated financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2004.

| AUDIT COMMITTEE | |

Dated: April 20, 2005 |

Richard G. Hinckley (Chairman) Pauline Hughes Francis Kristine F. Hughes Franz L. Cristiani |

26

As a stockholder, you may be entitled to present proposals, including nominations for director, for action at a forthcoming meeting if you comply with the requirements of the proxy rules established by the Securities and Exchange Commission. In order to be considered for inclusion in the proxy materials for the 2006 Annual Meeting of Stockholders, stockholder proposals, including nominations for director, must be received by our Secretary no later than December 21, 2005, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended. If a stockholder wishes to present a proposal at the 2006 Annual Meeting of Stockholders, the proposal must be sent to Nature's Sunshine Products, Inc., Stockholder Relations, 75 East 1700 South, Provo, Utah 84606 and received prior to March 6, 2006. The Board of Directors will review any proposal, which is received by that date and determine whether it is a proper proposal to present to the 2006 Annual Meeting.

As of the date of this Proxy Statement, our Board of Directors does not intend to present and has not been informed that any other person intends to present a matter for action at the 2005 Annual Meeting other than as set forth herein and in the Notice of Annual Meeting. If any other matter properly comes before the meeting, it is intended that the holders of proxies will act in accordance with their best judgment. The Board of Directors may read the minutes of the 2004 Annual Meeting of Stockholders and make reports, but stockholders will not be required to approve or disapprove such minutes or reports.

Copies of our Annual Report on Form 10-K (including financial statements and financial statement schedules) filed with the Securities and Exchange Commission may be obtained without charge by writing to Nature's Sunshine Products, Inc., Attn: Investor Relations Dept., 75 East 1700 South, Provo, UT 84606 or via our web site at www.natr.com. Copies of our 2004 Annual Report to Stockholders are being mailed with this Proxy Statement.

The enclosed Proxy is furnished for you to specify your choices with respect to the matters referred to in the accompanying notice and described in this Proxy Statement. If you wish to vote in accordance with the board's recommendations, please sign, date and return the Proxy in the enclosed envelope which requires no postage if mailed in the United States. A prompt return of your Proxy will be appreciated.

| Dated: April 20, 2005 | By Order of the Board of Directors, |

/s/ Douglas Faggioli |

|

DOUGLAS FAGGIOLI President, Chief Executive Officer, Director |

27

ANNUAL MEETING OF SHAREHOLDERS OF

NATURE'S SUNSHINE PRODUCTS, INC.

May 27, 2005

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

Please detach along perforated line and mail in the envelope provided.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF DIRECTORS AND "FOR" PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN

HERE ý

| FOR | AGAINST | ABSTAIN | ||||||||||||

| 1. | Election of Directors: | 2. | Ratification of selection of KPMG LLP as Independent Public Accountants. | o | o | o | ||||||||

o |

FOR ALL NOMINEES |

NOMINEES: o Kristine F. Hughes o Franz L. Cristiani |

3. |

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting. |

||||||||||

o |

WITHHOLD AUTHORITY FOR ALL NOMINEES |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2. |

||||||||||||

| o | FOR ALL EXCEPT (See instructions below) |

|||||||||||||

| Please sign and date this Proxy where shown below and return it promptly. | ||||||||||||||

No postage is required if this Proxy is returned in the enclosed envelope and mailed in the United States. |

||||||||||||||

| INSTRUCTION: | To withhold authority to vote for any individual nominee(s), mark "FOR ALL EXCEPT" and fill in the circle next to each nominee you wish to withhold, as shown here: ý | ||||

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | o | ||||

Signature of Shareholder |

Date: |

Signature of Shareholder |

Date: |

| Note: | Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |

PROXY

NATURE'S SUNSHINE PRODUCTS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Kristine F. Hughes and Douglas Faggioli and each of them as Proxies, with full power of substitution, and hereby authorizes them to represent and vote, as designated on the reverse, all shares of Common Stock of the Company held of record by the undersigned on April 11, 2005, at the Annual Meeting of Shareholders to be held at the Company's corporate offices at 75 East 1700 South, Provo, Utah 84606, on Friday, May 27, 2005, at 10:00 a.m., local time, or at any adjournment thereof.

(Continued and to be signed on the reverse side)