UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

Nature's Sunshine Products, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

NATURE'S SUNSHINE PRODUCTS, INC.

75 East 1700 South

Provo, UT 84606

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Friday, May 28, 2004

To Our Stockholders:

You are cordially invited to attend the 2004 Annual Meeting of Stockholders of Nature's Sunshine Products, Inc., a Utah corporation (the "Company"). The Annual Meeting will be held at the Company's corporate offices at 75 East 1700 South, Provo, Utah 84606, on Friday, May 28, 2004, at 10:00 a.m., local time, for the following purposes:

1. To elect two directors, each to serve a term of three years, and until each of their successors is elected and shall qualify;

2. To ratify the selection of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2004; and

3. To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

Our Board of Directors has fixed the close of business on April 9, 2004, as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting, and only stockholders of record at such date will be so entitled to notice and vote.

Please sign and date the enclosed Proxy and return it promptly in the enclosed postage-paid envelope whether or not you expect to attend the meeting. You may revoke your Proxy and vote in person if you decide to attend the meeting.

| Dated: April 9, 2004 | By Order of the Board of Directors, | |

/s/ DOUGLAS FAGGIOLI DOUGLAS FAGGIOLI President, Chief Executive Officer, Director |

YOUR VOTE IS IMPORTANT.

PLEASE FILL IN DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED POSTAGE PAID ENVELOPE. A PROXY IS REVOCABLE AT ANY TIME PRIOR TO THE VOTING OF THE PROXY, BY WRITTEN NOTICE TO THE SECRETARY OF THE COMPANY OR BY VOTING IN PERSON AT THE MEETING.

NATURE'S SUNSHINE PRODUCTS, INC.

PROXY STATEMENT—ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors of Nature's Sunshine Products, Inc. for use at our Annual Meeting of stockholders to be held at our corporate offices at 75 East 1700 South, Provo, Utah, on Friday, May 28, 2004 at 10:00 a.m., Mountain Time. Stockholders will consider and vote upon the proposals described herein and referred to in the Notice of the Meeting accompanying this Proxy Statement. This Proxy Statement and the enclosed proxy are first being sent to stockholders on or about April 15, 2004.

We are sending these proxy materials to all of our stockholders of record on April 9, 2004 (the "Record Date"). Only stockholders who owned shares of our common stock at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. We use several abbreviations in this Proxy Statement. We may refer to our company as "we," "us" or "our company" or the "Company." The term "Annual Meeting" means our 2004 Annual Meeting of Stockholders.

QUESTIONS AND ANSWERS ABOUT OUR 2004 ANNUAL MEETING

AND THIS PROXY STATEMENT

2

Proposal One—Election of Directors. The two nominees receiving the highest number of votes, in person or by proxy, will be elected to serve as Class II directors. You may vote either "FOR" or "WITHHOLD" your vote for the director nominees.

Proposal Two—Ratification of KPMG LLP as Independent Auditors. The ratification of KPMG LLP as our independent auditors will require the affirmative vote of a majority of the shares present at the Annual Meeting, in person or by proxy. You may vote "FOR," "AGAINST" or "ABSTAIN" from voting on this proposal.

If you return a signed proxy card (according to the enclosed instructions), you are enabling Kristine F. Hughes and Douglas Faggioli, who are named on the proxy card as "proxy holders," to vote your shares at the Annual Meeting in the manner you indicate on the proxy card. If you return a signed proxy card but you do not provide voting instructions on the card, your shares will be voted FOR Richard G. Hinckley and Eugene L Hughes to serve as Class II directors on our Board of Directors and FOR ratification of the appointment of KPMG LLP as our independent auditors for the current fiscal year. If an issue comes up for a vote at the meeting that is not described in this Proxy Statement,

3

Kristine F. Hughes and Douglas Faggioli will vote your shares, under your proxy, in their discretion.

If you attend the Annual Meeting and wish to vote in person, we will provide you with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in your name, but if you wish to vote in person at the Annual Meeting, you must bring with you to the meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

For shares of Common Stock that are beneficially owned by a stockholder and held in "street name" through a brokerage (if such stockholder's shares are registered in the name of a brokerage), your broker has the discretion to vote such shares on "routine matters" (such as election of directors), as more specifically described below.

4

5

6

PRINCIPAL HOLDERS OF COMMON STOCK

The following table sets forth information as of March 23, 2004, with respect to the beneficial ownership of our common stock by (i) each person who, to our knowledge, is the beneficial owner of more than 5 percent of our outstanding common stock, (ii) each director and nominee for director, (iii) each of the executive officers named in the Summary Compensation Table under "Executive Compensation", and all or our executive officers and directors as a group.

| Beneficial Owner |

Number of Shares Beneficially Owned(1) |

Percent of Class(2) |

|||

|---|---|---|---|---|---|

| Pauline Hughes Francis 311 East Canal Road Salem, UT 84653 |

2,225,939 | (3) | 15.0 | % | |

| Kristine F. Hughes Eugene L. Hughes 75 East 1700 South Provo, UT 84606 |

1,819,363 | (4) | 12.0 | % | |

| FMR Corp. 82 Devonshire Street Boston, MA 02109 |

1,527,800 | (5) | 10.4 | % | |

| First Wilshire Securities Management, Inc. 600 South Lake Street, Suite 100 Pasadena, CA 91106-3955 |

867,501 | (6) | 5.9 | % | |

| Douglas Faggioli 75 East 1700 South Provo, UT 84606 |

293,082 | (7) | 2.0 | % | |

| Dale Lee 75 East 1700 South Provo, UT 84606 |

192,823 | (8) | 1.3 | % | |

| John R. DeWyze 75 East 1700 South Provo, UT 84606 |

112,775 | (9) | .8 | % | |

| Craig D. Huff 75 East 1700 South Provo, UT 84606 |

104,676 | (10) | .7 | % | |

| Daren G. Hogge 75 East 1700 South Provo, UT 84606 |

103,760 | (11) | .7 | % | |

7

| Richard G. Hinckley 75 East 1700 South Provo, UT 84606 |

18,333 | (12) | .1 | % | |

| All executive officers and directors As a group (9 persons) |

4,870,751 | (13) | 30.5 | % |

8

PROPOSAL 1—ELECTION OF DIRECTORS

Under our Restated Articles of Incorporation, directors are divided into three classes, each class to consist, as nearly as possible, of one-third of the number of directors then constituting the entire Board of Directors. Each year, one class of directors is elected, each director to serve a term of three years. All of the directors were elected for staggered terms at the last three annual meetings.

At the Annual Meeting, two directors are to be elected to serve for a term of three years or until a successor for such director is elected and qualified, or until the death, resignation, or removal of such director. It is intended that the proxies will be voted for the two nominees named below for election to our Board of Directors unless authority to vote for any such nominee is withheld. Each of the nominees is currently serving as one of our directors. Each person nominated for election has agreed to serve if elected, and the Board of Directors has no reason to believe that any nominee will be unavailable or will decline to serve. In the event, however, that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the current Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them "FOR" the nominees named below. The two candidates receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected as directors of our company.

Certain information concerning the two nominees to the Board of Directors, and directors whose terms will continue after the Annual Meeting is set forth below. Biographical information regarding the nominees is set for below under "EXECUTIVE OFFICERS AND DIRECTORS."

9

| Name of Nominee |

Age |

Company Position Held |

Served as Director Since |

Class and Year Term Will Expire |

||||

|---|---|---|---|---|---|---|---|---|

| Richard G. Hinckley | 62 | Director | 1999 | Class II 2007 | ||||

| Eugene L Hughes | 73 | Founder and Director | 1980 | Class II 2007 | ||||

DIRECTORS WHOSE TERMS ARE CONTINUING |

||||||||

Kristine F. Hughes |

65 |

Chairperson of the Board and Director |

1980 |

Class III 2005 |

||||

| Pauline Hughes Francis | 62 | Director | 1988 | Class I 2006 | ||||

| Douglas Faggioli | 49 | President, Chief Executive Officer, Director | 1997 | Class I 2006 | ||||

Affirmative Determinations Regarding Director Independence

The Board of Directors has determined each of the following directors to be an "independent director" as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers (the "NASD"):

| Pauline Hughes Francis Kristine F. Hughes Richard G. Hinckley |

In this Proxy Statement, these three directors are referred to individually as an "Independent Director" and collectively as the "Independent Directors." The Independent Directors intend to meet in executive sessions at which only Independent Directors will be present in conjunction with each scheduled meeting of the Board of Directors.

Meetings and Committees of the Board of Directors

There were eight meetings of the Board of Directors held during 2003. All directors attended at least 75 percent of the meetings of the Board and Committees of the Board on which they served.

The Board of Directors has formed the following committees:

The Compensation Committee. The Compensation Committee, which held three meetings during 2003, reviews compensation policies applicable to officers and key employees and recommends to the Board of Directors the compensation to be paid to our chief executive and operating officers. The Compensation Committee also administers or supervises our various stock option and incentive compensation plans. The Compensation Committee has not adopted a written charter. The members of Compensation Committee are Pauline Hughes Francis

10

(Chairman), Kristine F. Hughes and Richard G. Hinckley, each of whom is an Independent Director.

The Audit Committee. The Audit Committee, which held four meetings during 2003, assists the Board in the oversight of our financial statements, legal compliance, qualifications of independent auditors, performance of the internal audit function and engagement and oversight of our independent auditors. The Audit Committee acts pursuant to a written charter adopted by the Board. A copy of the Audit Committee Charter is attached to this Proxy Statement as Appendix A.

The members of the Audit Committee are Richard G. Hinckley (Chairman), Kristine F. Hughes and Pauline Hughes Francis, each of whom is an Independent Director. Our Board of Directors has determined that Richard G. Hinckley is an audit committee financial expert, as that term is defined in Item 401(h) of Regulation S-K promulgated by the Securities and Exchange Commission.

The Nominating Committee. The Nominating Committee, which held 1 meeting during 2003, makes recommendations to the Board of Directors about the size of the Board or any committee thereof, identifies and recommends candidates for the Board and committee membership, evaluates nominations received from stockholders, determines the compensation and benefits of all directors on the Board and develops and recommends to the Board corporate governance principles applicable to our company. The Nominating Committee has not adopted a written charter.

The members of the Nominating Committee are Kristine F. Hughes, Pauline Hughes Francis and Richard G. Hinckley, each of whom is an Independent Director.

The Company's Director Nominations Process

The Board selects the Director nominees to stand for election at the Company's annual meetings of stockholders and to fill vacancies occurring on the Board, based on the recommendations of the Nominating Committee. In recommending nominees to serve as Directors, the Nominating Committee will examine each Director nominee, including persons nominated by stockholders, on a case-by-case basis regardless of who recommended the nominee and take into account all factors it considers appropriate. However, the Nominating Committee believes the following minimum qualifications must be met by a Director nominee to be recommended to the Board:

11

Recommendations for consideration by the Nominating Committee, including recommendations from stockholders of the Company, should be sent to the Board of Directors, care of the Secretary of the Company, at the Company's headquarters in writing together with appropriate biographical information concerning each proposed nominee. See also the section dealing with "Stockholder Proposals," below.

Communications with Directors

We have not in the past adopted a formal process for stockholder communications with the Board of Directors. Nevertheless, every effort has been made to ensure that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. We believe our responsiveness to stockholder communications to the Board has been excellent. Nevertheless, during the upcoming year the Board or the Nominating Committee of the Board will give full consideration to the adoption of a formal process for stockholder communications with the Board and, if adopted, publish it promptly and post it to our website.

Compensation of Directors

Board members who are also employees of our company do not receive any directors' fees. We pay our non-employee Board members directors' fees of $24,702 to $45,858 and its Chairman of the Board, $128,169 per year, as well as the cost of health and life insurance coverage. We do not pay any fees for attendance at Committee meetings.

12

EXECUTIVE OFFICERS AND DIRECTORS

Our executive officers and directors are:

| Name |

Position |

Age |

||

|---|---|---|---|---|

| Douglas Faggioli | President, Chief Executive Officer and Director | 49 | ||

| Kristine F. Hughes | Chairman of the Board and Director | 65 | ||

| Eugene L Hughes | Founder and Director | 73 | ||

| Pauline Hughes Francis | Director | 62 | ||

| Richard G. Hinckley | Director | 62 | ||

| Craig D. Huff | Executive Vice President, Chief Financial Officer, Vice President—Finance and Treasurer | 48 | ||

| Dale G. Lee | Executive Vice President, President—U.S.A. Sales Division | 59 | ||

| Daren G. Hogge | Executive Vice President, President—International Division | 42 | ||

| John R. DeWyze | Executive Vice President, Vice President—Operations | 47 |

Certain information regarding the business experience of the executive officers and directors is set forth below.

DOUGLAS FAGGIOLI. Mr. Faggioli is the President, Chief Executive Officer and a Director of our company. Prior to his appointment as president and CEO in November 2003, Mr. Faggioli was Executive Vice President, Chief Operating Officer and a Director of our company. He began his employment with us in 1983 and has served as one of our officers since 1989. He is a Certified Public Accountant.

KRISTINE F. HUGHES. Mrs. Hughes is our Chairman of the Board of Directors. She was a co-founder in 1972 of Hughes Development Corporation, a predecessor of our company, and has served as an officer or director of our company and/or its predecessors since 1980. Mrs. Hughes serves on several civic and community boards. She is the wife of Eugene L. Hughes, one of our founders and directors.

EUGENE L HUGHES. Mr. Hughes is a founder and a director of our company. He co-founded Hughes Development Corporation, a predecessor of our company, in 1972. He served as an officer or director of our company and/or its predecessors since 1972. Mr. Hughes serves on several community boards. He is the husband of Kristine F. Hughes, our Chairman.

PAULINE HUGHES FRANCIS. Mrs. Francis has been one of our Directors since 1988. Mrs. Francis was a co-founder in 1972 of Hughes Development Corporation, a predecessor of the company, and has acted as a consultant from time to time to our company and its predecessors.

RICHARD G. HINCKLEY. Mr. Hinckley has served as a Director of our company since 1999. He is a partner of Interior Space Systems, Inc. From 1996, Mr. Hinckley served as

13

Director of Corporate Development—Western Region, Nextlink Communications. From 1991 to 1996, he served as a Vice President of Beehive Travel until its merger with Morris Travel where he became the Director of Meetings and Incentives. He also served as president, director and part owner of Park 'n Jet, Utah's largest off-airport parking facility. Mr. Hinckley received his MBA degree from Stanford University.

CRAIG D. HUFF. Mr. Huff is our Executive Vice President, Chief Financial Officer, Vice President of Finance and Treasurer. He began his employment with us in 1982 and has served as an officer of our company since 1998. He is a Certified Public Accountant.

DALE G. LEE. Mr. Lee is Executive Vice President and President of the United States Sales Division of our company. He began his employment with us in 1978 and has served as one of our officers since 1989.

DAREN G. HOGGE. Mr. Hogge is Executive Vice President and President of our International Division. He began his employment with us in 1993, and has served as an officer of our company since 1997. He is a Certified Public Accountant.

JOHN R. DEWYZE. Mr. DeWyze is Executive Vice President and Vice President of Operations of our company. He began his employment with us in 1995. From 1982 to 1995, Mr. DeWyze was employed by Bristol-Myers Squibb. He has served as one of our officers since 1997.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely upon a review of Forms 3, 4 and 5 and amendments thereto as well as written representations provided to us by our executive officers, directors and 10 percent stockholders, we are unaware of any such persons failing to file on a timely basis any reports required by Section 16(a) of the Exchange Act during 2003, with the exception that Craig Huff filed a Form 4 in March 2004 for an option to purchase 2,000 shares of stock granted to him by our company on April 1, 2002.

Code of Ethics

We have adopted a code of ethics that applies to all employees of our company, including employees of our subsidiaries, as well as each member of our Board of Directors. The code of ethics is available at our website at: www.natr.com.

Compensation Summary

The following table sets forth information concerning the cash and non-cash compensation paid or to be paid by us to the two individuals who served as our chief executive officer in 2003 and to each of the other executive officers named below, for the three fiscal years ended December 31, 2003.

14

| |

|

|

|

|

Long-Term Compensation |

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

|

||||||||||

| |

Securities Under-Lying Options/SARS (Shares) |

|

||||||||||

| Name and Principal Position |

Year |

Salary ($)(1) |

Bonus ($) |

Other Annual Compensation ($)(2) |

All Other Compensation(3) ($) |

|||||||

| Douglas Faggioli(4) President, Chief Executive Officer |

2003 2002 2001 |

257,366 258,964 235,302 |

— — — |

— — |

2,000 25,000 95,690 |

1,338 1,314 1,235 |

||||||

Daniel P. Howells(5) Former President, Chief Executive Officer |

2003 2002 2001 |

351,240 354,000 320,027 |

— — |

— — |

— 250 158,460 |

7,858 7,902 7,411 |

||||||

Daren G. Hogge Executive Vice President, President—International |

2003 2002 2001 |

187,371 200,000 186,580 |

237,652 38,000 253,898 |

— — |

— — 104,630 |

730 734 665 |

||||||

Craig D. Huff Executive Vice President, Chief Financial Officer, Vice President, Finance |

2003 2002 2001 |

180,680 181,317 166,836 |

144,308 79,103 30,784 |

— — |

— 2,000 24,910 |

846 851 665 |

||||||

Dale G. Lee Executive Vice President President, U.S. Sales |

2003 2002 2001 |

179,482 190,756 184,884 |

25,990 — 139,398 |

— — — |

4,000 — 10,930 |

2,281 2,301 2,237 |

||||||

John R. DeWyze Executive Vice President, Vice President—Operations |

2003 2002 2001 |

164,689 177,000 165,418 |

32,816 24,399 29,586 |

— — |

— — 31,760 |

878 883 846 |

||||||

15

Employment Agreements

We have entered into employment agreements with each of our executive officers who receive base annual salaries currently ranging from approximately $172,000 to $350,000. These agreements are renewable on an annual basis and generally provide for an initial term of one year. In the event we terminate or do not renew an officer's employment without cause, the officer is generally entitled to receive the balance of his base salary for twelve months.

Executive Incentive Plans

We have from time to time adopted incentive plans for key management and/or other employees.

In 1997, the Board of Directors adopted an Incentive Compensation Plan ("Bonus Plan"), which provides for bonuses ranging from 0% to 90% of base salary for all of our employees depending upon the employee's position with us. Up to 40% of the bonus for certain key employees is determined by how well an employee achieves certain specified individual performance objectives, and the balance is determined by how well we achieve certain sales and operating income goals. Payments totaling approximately $441,000, $142,000 and $454,000 were made to executive officers for services rendered in 2003, 2002 and 2001, respectively, for this or similar executive incentive plans. Amounts paid, if any, to the officers participating in the Bonus Plan are included in the Summary Compensation Table.

In 1999, we adopted an Executive Loan Program. The Loan Program was intended to assist executive officers to purchase our common stock. Loans were limited to $59,000. Loans were secured by the purchased common stock and bore interest at the current prime rate. The notes were due 90 days after demand or 90 days after termination of employment. No new loans will be made under the program and no amounts are currently outstanding.

Stock Option Plans

Our 1995 Stock Option Plan, as amended (the "1995 Plan"), authorizes the grant of incentive and non-qualified stock options to officers and key employees. The 1995 Plan currently allows for the granting of a maximum of 4,150,000 shares of our common stock (adjusted for stock splits and dividends).

Options issued under the 1995 Plan must have an exercise price at least equal to the fair market value on the date of grant and a term of not more than ten years. Options are generally not transferable and are exercisable in accordance with vesting schedules established by the Compensation Committee (the "Committee") of the Board of Directors administering the Plan. The Committee establishes with respect to each option granted to an employee, and sets forth in the option agreement, the effect of the termination of employment on the rights and benefits thereunder. In the event of certain changes in control of our company, options generally become immediately exercisable.

16

As of March 23, 2004, there were 2,177,245 shares subject to non-qualified options issued and outstanding under the 1995 Plan and 145,553 shares are available for issuance (as adjusted for stock splits and dividends). See "Executive Incentive Plans" above.

We also have 433,700 shares subject to non-qualified options issued and outstanding, which were granted under stock option plans or arrangements that have been terminated.

Option Grants in Fiscal Year 2003

The following table sets forth a summary of certain non-qualified stock options granted to our named executive officers during 2003.

| |

|

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Granted (Shares) |

Total Granted to Employees in 2003 (%) |

Exercise Price Per Share |

Expiration Date |

|||||||||||

| 5% |

10% |

||||||||||||||

| Douglas Faggioli | 2,000 | 3.02 | % | $ | 8.80 | 4/01/2013 | $ | 5,986 | $ | 13,579 | |||||

| Daren G. Hogge | 500 | 0.75 | % | $ | 9.97 | 5/01/2013 | $ | 1,696 | $ | 3,847 | |||||

| Dale G. Lee | 4,000 | 6.04 | % | $ | 8.51 | 3/03/2013 | $ | 11,577 | $ | 26,264 | |||||

The following table and notes provide information about shares of our common stock that were issuable as of December 31, 2003 pursuant to exercise of options under existing equity compensation plans.

| Plan Category |

Number of securities to be issued upon exercise of outstanding options |

Weighted-average exercise price of outstanding options |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) |

|||||

|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 2,772,496 | (1) | $ | 8.27 | 195,553 | (1) | ||

| Equity compensation plans not approved by security holders | 338,600 | (2) | $ | 8.32 | — | |||

| Total | 3,111,096 | $ | 8.28 | 195,553 | ||||

17

Option Exercises During 2003 and 2003 Year-end Value Table

The following table sets forth certain information regarding the value of non-qualified stock options held by the named executive officers during 2003 (as adjusted for stock splits and dividends).

| Name |

Shares Acquired on Exercise # |

Value Received $ |

Number of Unexercised options at December 31, 2003 Exercisable/Unexercisable # |

Value of Unexercised In-the-Money Options at December 31, 2003 Exercisable/Unexercised $ |

||||

|---|---|---|---|---|---|---|---|---|

| Douglas Faggioli | — | — | 232,390/2,000 | 144,884/0 | ||||

| Daniel P. Howells | 30,000 | 15,494 | 294,060/0 | 204,985/0 | ||||

| Daren G. Hogge | — | — | 102,210/500 | 62,433/0 | ||||

| Craig D. Huff | — | — | 91,010/2,000 | 65,521/0 | ||||

| Dale G. Lee | 31,350 | 49,636 | 152,830/4,000 | 78,954/0 | ||||

| John R. DeWyze | — | — | 109,070/0 | 55,023/0 |

401(k) Plan

We sponsor a qualified deferred compensation plan ("401(k) Plan") under Section 401(k) of the Internal Revenue Code, in which full-time employees may reduce their salaries by up to 15% of their compensation limited to a maximum of $12,000 and have the salary reduction amounts contributed to the 401(k) Plan. Such contributions are 100% matched by us, up to a maximum of 5 percent of the employee's compensation. Participants are fully vested at all times in their salary reduction contributions and after three years of service are fully vested in matching company contributions. Participants are eligible to receive distribution of vested amounts upon retirement, death or disability, or termination of employment. Contributions by us to the 401(k) Plan were approximately $902,000, $894,000 and $743,000 for 2003, 2002 and 2001, respectively. Amounts contributed for executive officers participating in the 401(k) Plan are included in the Summary Compensation Table above.

Deferred Compensation Plan

Under our nonqualified deferred compensation plan for its executive officers, up to 100 percent of the officer's annual salary and bonus (less the officer's share of employment taxes) may be deferred. The deferrals become an obligation owed to the officer by us under the Plan. At December 31, 2003 and 2002, the amounts payable under the Plan are valued at the fair market value of the related assets and total $2.2 million and $1.5 million, respectively. Amounts deferred for executive officers participating in the nonqualified deferred compensation plan are included in the Summary Compensation Table above.

18

Compensation Committee Interlocks and Insider Participation

The Board of Directors' Compensation Committee is composed of Pauline Hughes Francis, Kristine F. Hughes and Richard G. Hinckley.

THE FOLLOWING REPORT OF THE COMPENSATION COMMITTEE AND THE PERFORMANCE GRAPH THAT APPEARS IMMEDIATELY AFTER SUCH REPORT SHALL NOT BE DEEMED TO BE SOLICITNG MATERIAL OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO FILED.

To: The Board of Directors

As members of the Compensation Committee (the "Committee"), it is our duty to administer or supervise various stock option and incentive compensation plans of the Company. In addition, the Committee recommends to the Board of Directors the compensation to be paid to the Company's chief executive and operating officers. The Committee also reviews compensation policies applicable to officers and key employees and considers the relationship of corporate performance to that compensation.

The Committee submits a report to the Board concerning the compensation policies followed by the Committee in recommending compensation for the Company's chief executive officer and chief operating officer. In establishing such compensation for 2003, the Committee considered a number of factors, including what it believed to be the competitive level of compensation that is necessary to attract, retain and motivate qualified officers. In this regard, the Committee reviewed several salary reports and surveys. The Committee also considered:

For 2003 salaries, the Committee applying the factors set forth above did not increase base salaries for the chief executive officer and chief operating officer. In 2003, other salaries of executive officers were set by the chief executive officer and chief operating officer using the same factors as set forth above. There were no salary increases for the other executive officers in 2003. For 2004, the chief executive officer as well as all executive officers received pay increases of approximately three percent.

19

The compensation policy of the Company, which is endorsed by the Committee, is that a substantial portion of the annual compensation of each officer relate to and be contingent upon the performance of the Company, as well as the individual contribution of each officer. As a result, much of an officer's compensation is subject directly to annual bonus compensation measured by the Company's achievement of certain sales and income goals. Under the Company's Incentive Compensation Plan, bonuses are paid based on the officer's performance and the performance of the entire Company. The Committee believes the compensation paid to its officers is reasonable in view of the Company's performance and the contribution of the officers to that performance.

All officers and key employees participate in the Company's stock option plans. The Committee believes that stock options have been effective in attracting, motivating and retaining executives and key employees. During 2003, the Committee recommended stock option grants in the aggregate amount of 66,250 shares.

Except for Kristine F. Hughes, no member of the Committee is a former or current officer or employee of the Company or any of its subsidiaries. Mrs. Hughes served as President and CEO of the Company from September 1996 to October 1997.

| COMPENSATION COMMITTEE | ||

Dated: April 9, 2004 |

Pauline Hughes Francis Kristine F. Hughes Richard G. Hinckley |

20

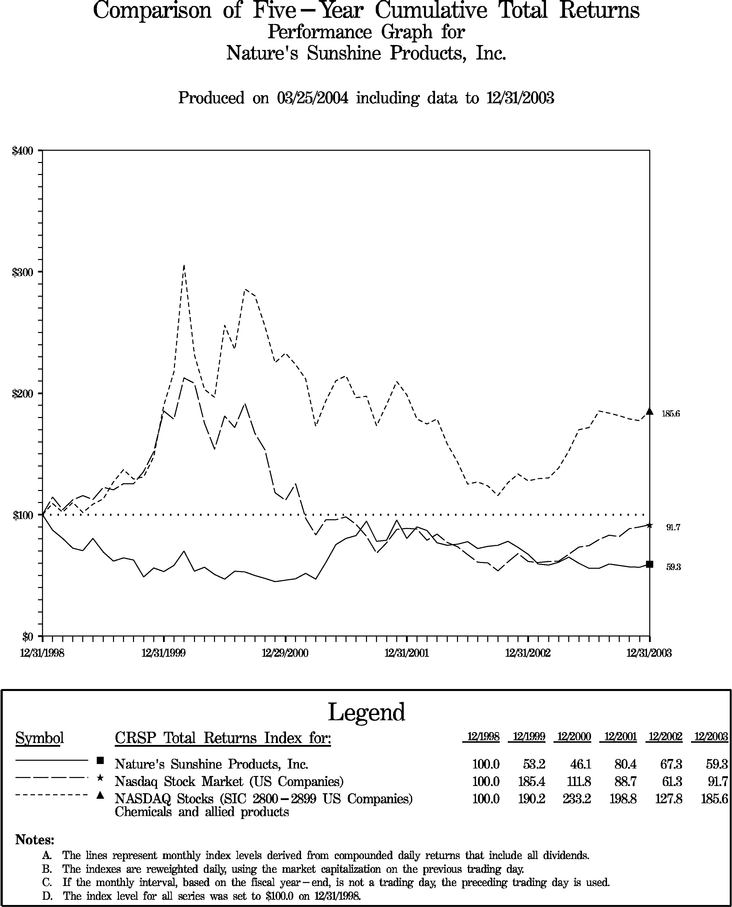

The following graph compares the performance (total return on investment as measured by the change in the year-end stock price plus reinvested dividends) of our common stock ("NATR") with that of the Index for NASDAQ National Stock Market (U.S. companies) and the Index for NASDAQ Stock (SIC 2800-2899) (herbal vitamins companies) for the five years ended December 31, 2003.

21

PROPOSAL 2: RATIFICATION OF INDEPENDENT AUDITORS

Our Audit Committee has recommended to the Board of Directors that KPMG LLP be selected as our independent auditors. The Board of Directors has accepted this recommendation and has selected KPMG LLP to be our independent auditors for the fiscal year ending December 31, 2004. KPMG LLP served as our auditors for the fiscal years ended December 31, 2002 and 2003.

We are asking the stockholders to ratify the selection of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2004. The affirmative vote of the holders of a majority of the shares represented and voting on this proposal will be required to ratify the selection of KPMG LLP.

In the event the stockholders fail to ratify the appointment, the Audit Committee will consider it as a direction to select other auditors for the subsequent year. Even if the selection is ratified, the Board of Directors or Audit Committee in their discretion may direct the appointment of a different independent auditing firm at any time during the year if the Board of Directors determines that such change would be in the best interest of our company and its stockholders.

Representatives of KPMG LLP are expected to attend the Annual Meeting and will have an opportunity to make a statement if they desire to do so, and they will be available to answer appropriate questions from stockholders.

The Board of Directors unanimously recommends that our stockholders vote FOR the proposal to ratify the selection of KPMG LLP to serve as our independent auditors for the fiscal year ending December 31, 2004.

Recent Changes in Accountants

As was previously reported in our Current Report on Form 8-K filed on July 12, 2002, on July 8, 2002, we engaged KPMG LLP as the Company's independent auditors and dismissed Arthur Andersen LLP. The decision to change auditors was recommended and approved by our Audit Committee and approved by our Board of Directors on July 8, 2002. During the two most recent fiscal years ended December 31, 2001 and 2000 and the subsequent interim reporting periods from the last audit date of December 31, 2001, through and including the termination date of July 8, 2002, there were no disagreements between us and Arthur Andersen LLP on any matter of accounting principles or practices, financial statement disclosure, accounting scope or procedure, or any reportable events. The report of Arthur Andersen LLP on the our financial statements for the two fiscal years ended December 31, 2001 and 2000 contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope, or accounting principles.

We had not consulted with KPMG LLP during the two fiscal years ended December 31, 2001 and 2000 or during the subsequent interim reporting periods from the last audit date of December 31, 2001, through and including the termination date of July 8, 2002, on either the

22

application of accounting principles or type of opinion KPMG LLP might issue on our financial statements.

Audit and Other Fees

The following table presents fees for professional services rendered by KPMG LLP for the audit of our annual financial statements for the fiscal years ended December 31, 2003 and December 31, 2002 and fees billed for other services rendered by KPMG LLP during those periods:

| |

Fiscal 2003 |

Fiscal 2002 |

||||

|---|---|---|---|---|---|---|

| Audit Fees(1) | $ | 332,353 | $ | 195,000 | ||

| Audit-Related Fees(2) | 24,502 | — | ||||

| Tax Fees(3) | 131,091 | 54,000 | ||||

| All Other Fees | — | — | ||||

| Total | $ | 487,946 | $ | 249,000 | ||

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the independence of KPMG and has concluded that it is.

Pre-Approval Policy

The policy of the Audit Committee is to pre-approve all auditing and non-auditing services of the independent auditors, subject to de minimus exceptions for other than audit, review, or attest services that are approved by the Audit Committee prior to completion of the audit. Alternatively, the engagement of the independent auditors may be entered into pursuant to pre-approved policies and procedures established by the Committee, provided that the policies and procedures are detailed as to the particular services and the Committee is informed of each service.

23

The Audit Committee of Nature's Sunshine Products, Inc., is composed of three independent directors and operates under written charter adopted by the Company's Board of Directors in 2003. The Audit Committee is currently comprised of Richard G. Hinckley (Chairman), Pauline Hughes Francis and Kristine F. Hughes. During the period that each member has served on the Audit Committee, each has been "independent" as this term applies to Rule 4200(a)(15) of the National Association of Securities Dealers' ("NASD") and its listing standards.

To: The Board of Directors

We have reviewed and discussed with management the Company's audited consolidated financial statements as of and for the year ended December 31, 2003.

We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and letter from the independent auditors required by the Independence Standards Board, and have discussed with the auditors the auditors' independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the consolidated financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2003.

| AUDIT COMMITTEE | ||

Dated: April 9, 2004 |

Richard G. Hinckley Pauline Hughes Francis Kristine F. Hughes |

As a stockholder, you may be entitled to present proposals, including nominations for director, for action at a forthcoming meeting if you comply with the requirements of the proxy rules established by the Securities and Exchange Commission. In order to be considered for inclusion in the proxy materials for the 2005 Annual Meeting of Stockholders, stockholder proposals, including nominations for director, must be received by our Secretary no later than December 31, 2004, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended. If a stockholder wishes to present a proposal at the 2005 Annual Meeting of Stockholders, the proposal must be sent to Nature's Sunshine Products, Inc., Stockholder Relations, 75 East 1700 South, Provo, Utah 84606 and received prior to December 31, 2004. The Board of Directors will review any proposal, which is received

24

by that date and determine whether it is a proper proposal to present to the 2005 Annual Meeting.

As of the date of this Proxy Statement, our Board of Directors does not intend to present and has not been informed that any other person intends to present a matter for action at the 2004 Annual Meeting other than as set forth herein and in the Notice of Annual Meeting. If any other matter properly comes before the meeting, it is intended that the holders of proxies will act in accordance with their best judgment. The Board of Directors may read the minutes of the 2003 Annual Meeting of Stockholders and make reports, but stockholders will not be required to approve or disapprove such minutes or reports.

Copies of our Annual Report on Form 10-K (including financial statements and financial statement schedules) filed with the Securities and Exchange Commission may be obtained without charge by writing to Nature's Sunshine Products, Inc., Attn: Investor Relations Dept., 75 East 1700 South, Provo, UT 84606 or via our web site at www.natr.com. Copies of our 2003 Annual Report to Shareholders are being mailed with this Proxy Statement.

The enclosed Proxy is furnished for you to specify your choices with respect to the matters referred to in the accompanying notice and described in this Proxy Statement. If you wish to vote in accordance with the board's recommendations, please sign, date and return the Proxy in the enclosed envelope which requires no postage if mailed in the United States. A prompt return of your Proxy will be appreciated.

| Dated: April 9, 2004 | By Order of the Board of Directors, | |

/s/ DOUGLAS FAGGIOLI DOUGLAS FAGGIOLI President, Chief Executive Officer, Director |

25

Appendix A

Audit Committee Charter

Purpose

The purpose of the Audit Committee ("Committee") is to oversee the processes of accounting and financial reporting of Nature's Sunshine Products, Inc. (the "Company") and the audits and financial statements of the Company.

Committee Structure

The Committee shall consist of at least three directors. Each member of the Committee shall meet the independence and experience requirements of the Nasdaq Stock Market, Section 10A(m)(3) of the Securities Exchange Act of 1934 (the "Exchange Act") and the rules and regulations of the Securities and Exchange Commission ("SEC"), as affirmatively determined by the Company's Board of Directors ("Board"). In addition, at least one member of the Committee shall be an "audit committee financial expert" as that term is defined by the SEC. The Board may, at any time and in its complete discretion, replace a Committee member.

Meetings

The Committee shall meet as often as it determines, but not less frequently than quarterly. The Committee shall maintain minutes and other relevant documentation of all its meetings.

Committee Authority and Responsibilities

The Committee shall directly appoint, subject to shareholder ratification, retain, and compensate the Company's independent auditors. The Committee has the sole authority to approve all audit engagement fees and terms, as well as all significant non-audit engagements with the independent auditors. The Committee shall be directly responsible for overseeing the work of the independent auditors (including resolution of disagreements between management and the independent auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or related work, and the independent auditors shall report directly to the Committee.

The Committee shall preapprove all auditing and non-auditing services of the independent auditors, subject to de minimus exceptions for other than audit, review, or attest services that are approved by the Committee prior to completion of the audit. Alternatively, the engagement of the independent auditors may be entered into pursuant to pre-approved policies and procedures established by the Committee, provided that the policies and procedures are detailed as to the particular services and the Committee is informed of each service.

The Committee shall have the authority to engage, without Board approval, independent legal, accounting, and other advisors as it deems necessary to carry out its duties. The Company shall provide appropriate funding, as determined by the Committee, to compensate the independent auditors, outside legal counsel, or any other advisors employed by the Committee,

26

and to pay ordinary Committee administrative expenses that are necessary and appropriate in carrying out its duties.

The Committee shall review and reassess the adequacy of this Charter on an annual basis and submit proposed changes to the Board for approval. The Committee has the powers and responsibilities delineated in this Charter. It is not, however, the Committee's responsibility to prepare and certify the Company's financial statements, to guaranty the independent auditors' report, or to guaranty other disclosures by the Company. These are the fundamental responsibilities of management and the independent auditors. Committee members are not full-time Company employees and are not performing the functions of auditors or accountants.

Oversight of the Company's Auditors

The Committee shall assure the regular rotation of the lead audit partner as required by Section 10A(j) of the Exchange Act, and consider whether, to assure continuing auditor independence, there should be regular rotation of the independent auditing firm itself.

The Committee shall set clear hiring policies for employees or former employees of the independent auditing firm that are consistent with Section 10A(l) of the Exchange Act.

The Committee shall ensure receipt of a written report from the independent auditors at least annually regarding (a) the independent auditors' internal quality-control procedures, (b) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, by any inquiry or investigation by governmental or professional authorities within the preceding five years respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues, and (c) to assess the auditors' independence, all relationships between the independent auditors and the Company, including each non-audit service provided to the Company and at least the matters set forth in Independent Standards Board No. 1.

Disclosure and Financial Statements

The Committee shall obtain, review and discuss reports from the independent auditors regarding: (1) all critical accounting policies and practices to be used; (2) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management officials of the Company, ramifications of the use of these alternative disclosures and treatments, and the treatment preferred by the independent auditors and the reasons for favoring that treatment; and (3) other material written communications between the independent auditors and Company management, such as any management letter or schedule of unadjusted differences.

The Committee shall discuss with the independent auditors and then disclose the matters required to be discussed and disclosed by SAS 61, including any difficulties the independent auditors encountered in the course of the audit work, any restrictions on the scope of the independent auditors' activities or on access to requested information, and any significant disagreements with management.

27

The Committee shall prepare the report required by the SEC to be included in the Company's annual proxy statement.

The Committee shall review the CEO and CFO's disclosure and certifications under Sections 302 and 906 of the Sarbanes-Oxley Act and shall review the adequacy and effectiveness of the Company's internal control system and procedures.

Compliance and Regulatory Oversight Responsibilities

The Committee shall review and approve all "related party transactions", as that term is defined in Item 404 of Regulation S-K.

The Committee shall establish procedures for the receipt, retention, and treatment of complaints received by the Company from its employees regarding accounting, internal accounting controls, and auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The Committee shall ascertain annually from the independent auditors whether the Company has issues under Section 10A(b) of the Exchange Act.

The Committee shall review with management and the independent auditors any correspondence with regulators and any published reports that raise material issues regarding the Company's accounting policies.

28

ANNUAL MEETING OF SHAREHOLDERS OF

NATURE'S SUNSHINE PRODUCTS, INC.

May 28, 2004

Please

date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

Please detach along perforated line and mail in the envelope provided.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF DIRECTORS AND "FOR" PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ý

| 1. | Election of Directors. | |||||||

| o | FOR ALL NOMINEES | NOMINEES | ||||||

| o | WITHHOLD AUTHORITY FOR ALL NOMINEES |

o | Richard G. Hinckley | |||||

| o | FOR ALL EXCEPT (See instructions below) |

o | Eugene L Hughes |

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark "FOR ALL EXCEPT" and fill in the circle next to each nominee you wish to withhold, as shown here: ý

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. o

| 2. | Ratification of selection of KPMG LLP as Independent Public Accountants. | FOR o |

AGAINST o |

ABSTAIN o |

||||

| 3. | In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting. | |||||||

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2.

Please sign and date this Proxy where shown below and return it promptly.

No postage is required if this Proxy is returned in the enclosed envelope and mailed in the United States.

| Signature of Shareholder | Date: | Signature of Shareholder | Date: | |||||||

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

PROXY

NATURE'S SUNSHINE PRODUCTS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Kristine F. Hughes and Douglas Faggioli and each of them as Proxies, with full power of substitution, and hereby authorizes them to represent and vote, as designated on the reverse, all shares of Common Stock of the Company held of record by the undersigned on April 9, 2004, at the Annual Meeting of Shareholders to be held at the Company's corporate offices at 75 East 1700 South, Provo, Utah 84606, on Friday, May 28, 2004, at 10:00 a.m., local time, or at any adjournment thereof.

(Continued and to be signed on the reverse side)