SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý |

||

| Filed by a Party other than the Registrant o | ||

Check the appropriate box: |

||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 |

|

NATURE'S SUNSHINE PRODUCTS, INC. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| o | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

NATURE'S SUNSHINE PRODUCTS, INC.

75 East 1700 South

Provo, UT 84606

NOTICE AND PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

Friday, May 24, 2002

To Our Stockholders:

Notice is hereby given that the 2002 Annual Meeting of Stockholders of Nature's Sunshine Products, Inc., a Utah corporation (the "Company") will be held at the corporate offices at 75 East 1700 South, Provo, Utah 84606, on Friday, May 24, 2002, at 10:00 a.m., local time, for the following purposes:

1. To elect two directors, each to serve a term of three years, and until each of their successors is elected and shall qualify; and

2. To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

The Board of Directors has fixed the close of business on April 10, 2002, as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting, and only stockholders of record at such date will be so entitled to notice and vote.

Please sign and date the enclosed Proxy and return it promptly in the enclosed postage-paid envelope whether or not you expect to attend the meeting. You may revoke your Proxy and vote in person if you decide to attend the meeting.

| Dated: April 10, 2002 | By Order of the Board of Directors, | |

/s/ Brent F. Ashworth |

||

BRENT F. ASHWORTH Secretary |

YOUR VOTE IS IMPORTANT.

PLEASE FILL IN, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED POSTAGE PAID ENVELOPE. A PROXY IS REVOCABLE AT ANY TIME PRIOR TO THE VOTING OF THE PROXY, BY WRITTEN NOTICE TO THE SECRETARY OF THE COMPANY OR BY VOTING IN PERSON AT THE MEETING.

NATURE'S SUNSHINE PRODUCTS, INC.

PROXY STATEMENT—ANNUAL MEETING OF STOCKHOLDERS

GENERAL

This Proxy Statement is furnished in connection with the solicitation of Proxies by the Board of Directors of Nature's Sunshine Products, Inc. ("the Company") for use at the Annual Meeting of Stockholders to be held at the Company's corporate offices at 75 East 1700 South, Provo, Utah 84606, on May 24, 2002 at 10:00 a.m., Mountain time. The stockholders of the Company will consider and vote upon the proposals described herein and referred to in the Notice of the Meeting accompanying this Proxy Statement.

Stockholders of record at the close of business on April 10, 2002, are entitled to notice of and to vote at the Annual Meeting. As of the record date, 16,229,641 shares of the Company's Common Stock were outstanding. Each share of Common Stock is entitled to one vote on each matter to be considered at the Meeting. For a description of the principal holders of the Company's Common Stock, see "PRINCIPAL HOLDERS OF COMMON STOCK" below.

Shares represented by Proxies will be voted in accordance with the specifications made thereon by the stockholders. Any Proxy not specifying the contrary will be voted in favor of the Board of Directors' nominees for directors of the Company.

The Proxies being solicited by the Board of Directors may be revoked by any stockholder giving the Proxy at any time prior to the Annual Meeting by giving notice of such revocation to the Company in writing at the address provided below. The Proxy may also be revoked by any stockholder giving such Proxy who appears in person at the Annual Meeting and advises the Chairman of the Meeting of his intent to revoke the Proxy.

The principal executive offices of the Company are located at 75 East 1700 South, Provo, Utah 84606. This Proxy Statement and the enclosed Proxy are being furnished to stockholders on or about April 12, 2002.

PRINCIPAL HOLDERS OF COMMON STOCK

The following table sets forth information as of March 25, 2002, with respect to the beneficial ownership of the Company's Common Stock by (i) each person who, to the knowledge of the Company, is the beneficial owner of more than 5 percent of the Company's outstanding Common Stock, (ii) each director and nominee for director, (iii) each of the executive officers named in the Summary Compensation Table under "Executive Compensation", and all executive officers and directors of the Company as a group.

| Beneficial Owner |

Number of Shares Beneficially Owned(1) |

Percent of Class(2) |

|||

|---|---|---|---|---|---|

| Pauline T. Hughes 311 East Canal Road Salem, UT 84653 |

2,271,604 | (3) | 13.9 | % | |

| Kristine F. Hughes Eugene L. Hughes 75 East 1700 South Provo, UT 84606 |

1,850,451 | (4) | 11.1 | ||

| FMR Corp. 82 Devonshire Street Boston, MA 02109 |

1,759,090 | (5) | 10.8 | ||

| Wellington Management Company, LLP 75 State Street Boston, MA 02109 |

1,579,800 | (6) | 9.7 | ||

| Daniel P. Howells 75 East 1700 South Provo, UT 84606 |

270,860 | (7) | 1.6 | ||

| Daren G. Hogge 75 East 1700 South Provo, UT 84606 |

161,930 | (8) | 1.0 | ||

| Dale G. Lee 75 East 1700 South Provo, UT 84606 |

188,008 | (9) | 1.1 | ||

| Douglas Faggioli 75 East 1700 South Provo, UT 84606 |

227,280 | (10) | 1.4 | ||

| Craig D. Huff Provo, UT 84606 |

80,390 | (11) | .5 | ||

| Richard G. Hinckley 75 East 1700 South Provo, UT 84606 |

10,000 | (12) | .1 | ||

| All executive officers and directors As a group (10 persons) |

5,064,005 | (13) | 28.6 |

PROPOSAL 1—ELECTION OF DIRECTORS

In accordance with the Bylaws of the Company, the Board of Directors has fixed its number at six members. All other directors were elected for staggered terms at the last three annual meetings.

Under the Company's Restated Articles of Incorporation, directors are divided into three classes, each class to consist, as nearly as possible, of one-third of the number of directors then constituting the entire Board of Directors. Each year, one class of directors is elected, each director to serve a term of three years.

At the Annual Meeting, two directors, Kristine F. Hughes and Daniel P. Howells, will stand for election to serve three years and thereafter until each of their successors are elected and shall qualify.

In the absence of instructions to the contrary, the persons named in the Proxy will vote the Proxies for the election of the nominees listed below, unless otherwise specified in the Proxy. The Board of Directors has no reason to believe that the nominees will be unable to serve, but if either nominee should become unable to serve, the Proxies will be voted for such other person(s) as the Board of Directors shall recommend.

Certain information concerning the two nominees to the Board of Directors, and directors whose terms will continue after the Annual Meeting is set forth below.

NOMINEES

| Name of Nominee |

Age |

Company Position Held |

Served as Director Since |

Class and Year Term Will Expire |

||||

|---|---|---|---|---|---|---|---|---|

| Kristine F. Hughes | 63 | Chairperson of the Board and Director | 1980 | Class III 2005 (if re-elected) | ||||

| Daniel P. Howells | 61 | President, CEO and Director | 1997 | Class III 2005 (if re-elected) | ||||

DIRECTORS WHOSE TERMS ARE CONTINUING |

||||||||

| Pauline T. Hughes | 60 | Director | 1988 | Class I 2003 | ||||

| Douglas Faggioli | 47 | Exec. Vice President, COO and Director | 1997 | Class I 2003 | ||||

| Richard G. Hinckley | 60 | Director | 1999 | Class II 2004 | ||||

| Eugene L. Hughes | 70 | Senior Vice President and Director | 1980 | Class II 2004 | ||||

Compensation of Directors

Board members who are also employees of the Company do not receive any directors' fees. The Company pays its non-employee Board members directors' fees of $20,800 to $44,650 and its Chairman of the Board, $124,800 per year, as well as the cost of health and life insurance coverage. The Company does not pay any fees for attendance at Committee meetings.

Board and Committee Meetings and Attendance

There were five meetings of the Board of Directors held during 2001. All directors attended at least 75 percent of the meetings of the Board and Committees of the Board on which they served.

The Board of Directors has a Compensation Committee, which consists of Pauline T. Hughes, Kristine F. Hughes and Richard G. Hinckley. The Compensation Committee recommends to the Board of Directors the compensation to be paid to the Company's chief executive and chief operating officers. There were four meetings of the Compensation Committee during 2001.

The Board of Directors also has an Audit Committee, which consists of Richard G. Hinckley, Kristine F. Hughes and Pauline T. Hughes. The function of the Audit Committee is generally to approve the engagement of the Company's independent public accountants and to review audit and non-audit services provided by such accountants. There were four meetings of the Audit Committee during 2001.

The Board of Directors has also established a Nominating Committee consisting of Kristine F. Hughes, Pauline T. Hughes and Richard G. Hinckley. The Nominating Committee considers and recommends nominations for election to the Board of Directors. The Nominating Committee considers recommendations of stockholders. There were no meetings of the Nominating Committee during 2001.

EXECUTIVE OFFICERS AND DIRECTORS

The executive officers and directors of the Company are:

| Name |

Position |

Age |

||

|---|---|---|---|---|

| Daniel P. Howells | President, Chief Executive Officer and Director | 61 | ||

| Kristine F. Hughes | Chairperson of the Board and Director | 63 | ||

| Eugene L. Hughes | Senior Vice President and Director | 71 | ||

| Pauline T. Hughes | Director | 60 | ||

| Richard G. Hinckley | Director | 60 | ||

| Douglas Faggioli | Executive Vice President, Chief Operating Officer and Director | 47 | ||

| Craig D. Huff | Executive Vice President, Chief Financial Officer, Vice President—Finance and Treasurer | 46 | ||

| Dale G. Lee | Executive Vice President, President—U.S.A. Sales Division | 56 | ||

| Daren G. Hogge | Executive Vice President, President—International Division | 40 | ||

| John R. DeWyze | Executive Vice President, Vice President—Operations | 45 |

Certain information regarding the business experience of the executive officers and directors is set forth below.

DANIEL P. HOWELLS. Mr. Howells is the President, Chief Executive Officer and a Director of the Company. He began his employment with the Company in 1997. From 1991-1997, Mr. Howells served as President and CEO of Resorts U.S.A., Bushkil, PA Division of Rank Group, London, England. From 1985-1990, he served as Executive Vice President and General Manager of the Marriott Management Service Division, Marriott Corporation. From 1972-1985, Mr. Howells was employed by Six Flags Corporation where he served as President and CEO from 1982-1985.

KRISTINE F. HUGHES. Mrs. Hughes is the Chairperson of the Board of Directors of the Company. Mrs. Hughes was a co-founder in 1972 of Hughes Development Corporation, a predecessor of the Company, and has served as an officer or director of the Company and/or its predecessors since 1980. Mrs. Hughes serves on several civic and community boards. She is the wife of Eugene L. Hughes.

EUGENE L. HUGHES. Mr. Hughes is Senior Vice President and a Director of the Company. Mr. Hughes was a co-founder in 1972 of Hughes Development Corporation, a predecessor of the Company. He has served as an officer or director of the Company and/or its predecessors since 1972. Mr. Hughes serves on several community boards. He is the husband of Kristine F. Hughes.

PAULINE T. HUGHES. Mrs. Hughes has been a Director of the Company since 1988. Mrs. Hughes was a co-founder in 1972 of Hughes Development Corporation, a predecessor of the Company, and has acted as a consultant from time to time to the Company and its predecessors.

RICHARD G. HINCKLEY. Mr. Hinckley has served as a Director of the Company since 1999. Mr. Hinckley is a partner of Interior Space Systems, Inc., as well as Horizon Paint Company. From 1996, Mr. Hinckley served as Director of Corporate Development—Western Region, Nextlink Communications. From 1991 to 1996, he served as a Vice President of Beehive Travel until its merger with Morris Travel where he became the Director of Meetings and Incentives. He also served as president, director and part owner of Park 'n Jet, Utah's largest off-airport parking facility. Mr. Hinckley received his MBA degree from Stanford University.

DOUGLAS FAGGIOLI. Mr. Faggioli is Executive Vice President, Chief Operating Officer and a Director of the Company. He began his employment with the Company in 1983 and has served as an officer of the Company since 1989. He is a Certified Public Accountant.

CRAIG D. HUFF. Mr. Huff is the Executive Vice President, Chief Financial Officer, Vice President of Finance and Treasurer of the Company. He began his employment with the Company in 1982 and has served as an officer of the Company since 1998. He is a Certified Public Accountant.

DALE G. LEE. Mr. Lee is Executive Vice President and President of U.S. Sales of the Company. He began his employment with the Company in 1978 and has served as an officer of the Company since 1989.

DAREN G. HOGGE. Mr. Hogge is Executive Vice President and President of International of the Company. He began his employment with the Company in 1993, and has served as an officer of the Company since 1997. He is a Certified Public Accountant.

JOHN R. DEWYZE. Mr. DeWyze is Executive Vice President and Vice President of Operations of the Company. He began his employment with the Company in 1995. From 1983 to 1994, Mr. DeWyze was employed by Bristol-Myers Squibb. He has served as an officer of the Company since 1997.

Compliance with Section 16(a) of the Exchange Act

Based solely upon a review of Forms 3, 4 and 5 and amendments thereto as well as written representations provided to the Company by its executive officers, directors and 10 percent stockholders, the Company is unaware of any such persons failing to file on a timely basis any reports required by Section 16(a) of the Exchange Act during 2001 or prior years.

Compensation Summary

The following table sets forth information concerning the cash and non-cash compensation paid or to be paid by the Company to its chief executive officer and to each of its executive officers named below, for the three fiscal years ended December 31, 2001.

SUMMARY COMPENSATION TABLE

| |

|

|

|

|

Long-Term Compensation |

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

|

||||||||||

| |

Securities Under-Lying Options/SARS (Shares) |

|

||||||||||

| Name and Principal Position |

Year |

Salary ($)(1) |

Bonus ($) |

Other Annual Compensation ($)(2) |

All Other Compensation(3) ($) |

|||||||

| Daniel P. Howells President, Chief Executive Officer |

2001 2000 1999 |

320,027 292,140 289,383 |

— 151,036 — |

— — — |

158,460 — 319,340 |

7,411 2,840 7,520 |

||||||

Daren G. Hogge Executive Vice President, President—International |

2001 2000 1999 |

186,580 156,537 152,763 |

253,898 111,657 21,714 |

— — — |

104,630 10,800 115,700 |

665 284 590 |

||||||

Dale G. Lee Executive Vice President, President—U.S. Sales |

2001 2000 1999 |

184,884 177,482 150,609 |

139,398 11,762 — |

— — — |

10,930 — 150,480 |

2,237 1,576 2,016 |

||||||

Douglas Faggioli Executive Vice President, Chief Operating Officer |

2001 2000 1999 |

235,302 220,541 220,000 |

— 92,856 — |

— — — |

95,690 — 209,370 |

1,235 703 1,606 |

||||||

Craig D. Huff Executive Vice President, Chief Financial Officer, Vice President, Finance |

2001 2000 1999 |

166,836 144,021 121,843 |

30,784 39,824 — |

— — — |

24,910 — 78,230 |

665 290 647 |

||||||

Employment Agreements

The Company has Employment Agreements with each of its executive officers who receive base annual salaries currently ranging from approximately $157,000 to $313,000. The Agreements are renewable on an annual basis and generally provide for an initial term of one year. In the event the Company terminates or does not renew an officer's employment without cause, the officer is generally entitled to receive the balance of his base salary for twelve months.

Executive Incentive Plans

The Company has from time to time adopted incentive plans for key management and/or other employees of the Company.

In 1997, the Board of Directors adopted an Incentive Compensation Plan ("Bonus Plan"), which provides for bonuses ranging from 0% to 90% of base salary for all employees of the Company depending upon the employee's position with the Company. Up to 40% of the bonus for certain key employees is determined by how well an employee achieves certain specified individual performance objectives, and the balance is determined by how well the Company achieves certain sales and operating income goals. Payments totaling $454,000, $457,000 and 43,000 were made to executive officers for services rendered in 2001, 2000 and 1999 for this or similar executive incentive plans. Amounts paid, if any, to the officers participating in the Bonus Plan are included in the Summary Compensation Table.

The Bonus Plan also provides that certain stock options will be granted to officers and key employees if the Company and the employee meet their performance objectives. In 2001 and 2000, executive officers earned options to purchase 426,380 and 23,060 shares, respectively, of the Company's Common Stock. The options earned were granted in February 2001 and February 2000 at fair market value and require three-year vesting. For years following December 31, 2000, there will be no provision for the granting of stock options under the Bonus Plan.

In 1999, the Company adopted an Executive Loan Program. The Program is intended to assist executive officers of the Company purchase the Company's Common Stock. Loans are limited to $59,000 and the proceeds must be used to purchase Common Stock of the Company. Loans are secured by the purchased Common Stock and bear interest at the current prime rate. The notes are due ninety days after demand or ninety days after termination of employment.

Stock Option Plans

The 1995 Stock Option Plan, as amended (the "1995 Plan") authorizes the grant of incentive and non-qualified stock options to officers and key employees. The 1995 Plan currently allows maximum of 4,150,000 shares of the Company's Common Stock (adjusted for stock splits and dividends).

Options issued under the 1995 Plan must have an exercise price at least equal to the fair market value on the date of grant and a term of not more than ten years. Options are generally not transferable and are exercisable in accordance with vesting schedules established by the Compensation Committee (the "Committee") of the Board of Directors administering the Plan. The Committee establishes with respect to each option granted to an employee, and sets forth in the option agreement, the effect of the termination of employment on the rights and benefits thereunder. In the event of certain changes in control of the Company, options generally become immediately exercisable.

As of March 25, 2002, there were 3,126,378 shares subject to non-qualified options outstanding under the 1995 Plan and 268,203 shares available for further issuance (as adjusted for stock splits and dividends). See "Executive Incentive Plans" above.

The Company also has 632,805 shares subject to non-qualified options outstanding, which were granted under stock option plans or arrangements that have been terminated.

OPTION GRANTS IN FISCAL YEAR 2001

The following table sets forth a summary of certain non-qualified stock options granted to the Company's named executive officers during 2001.

| |

|

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Granted (Shares) |

Total Granted to Employees in 2001 (%) |

Price Per Share |

Expiration Date |

|||||||||||

| 5% |

10% |

||||||||||||||

| Daniel P. Howells | 158,460 | 15.56 | % | $ | 7.69 | 2/5/2007 | $ | 414,318 | $ | 939,947 | |||||

| Daren G. Hogge | 104,630 | 10.27 | 7.69 | 2/5/2007 | 273,571 | 620,640 | |||||||||

| Dale G. Lee | 10,930 | 1.07 | 7.69 | 2/5/2007 | 28,578 | 64,834 | |||||||||

| Douglas Faggioli | 95,690 | 9.40 | 7.69 | 2/5/2007 | 250,196 | 567,610 | |||||||||

| Craig D. Huff | 24,910 | 2.45 | 7.69 | 2/5/2007 | 65,131 | 147,760 | |||||||||

OPTION EXERCISES DURING 2001 AND

2001 YEAR END VALUE TABLE

The following table sets forth certain information regarding the value of non-qualified stock options held by the named executive officers during 2001 (as adjusted for stock splits and dividends).

No executive officer exercised non-qualified stock options during 2001.

2001 Yearend Option Value

| |

Number of Unexercised Options at December 31, 2001 |

Value of Unexercised In-the-Money Options December 31, 2001 |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name |

||||||||||

| Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||

| Daniel P. Howells | 110,400 | 213,660 | $ | 440,496 | $ | 862,328 | ||||

| Daren G. Hogge | 51,160 | 135,650 | 199,595 | 538,664 | ||||||

| Dale G. Lee | 152,250 | 46,230 | 628,015 | 185,135 | ||||||

| Douglas Faggioli | 74,467 | 132,923 | 297,122 | 536,297 | ||||||

| Craig D. Huff | 44,067 | 46,943 | 175,826 | 188,848 | ||||||

401(k) Plan

The Company sponsors a qualified deferred compensation plan ("401(k) Plan") under Section 401(k) of the Internal Revenue Code, in which full-time employees may reduce their salaries by up to 10% of their compensation limited to a maximum of $10,500 and have the salary reduction amounts contributed to the 401(k) Plan. Such contributions are 100% matched by the Company, up to a maximum of 5 percent of the employee's compensation. Participants are fully vested at all times in their salary reduction contributions and after four years of service are fully vested in matching Company contributions. Participants are eligible to receive distribution of vested amounts upon retirement, death or disability, or termination of employment. Contributions by the Company to the 401(k) Plan were approximately $743,000, $623,000 and $640,000 for 2001, 2000 and 1999, respectively. Amounts contributed for executive officers participating in the 401(k) Plan are included in the Summary Compensation Table above.

Deferred Compensation Plan

Under the Company's nonqualified deferred compensation plan for its executive officers, up to 100 percent of the officer's annual salary and bonus (less the officer's share of employment taxes) may be deferred. The deferrals become an obligation owed to the officer by the Company under the Plan. At December 31, 2001 and 2000, the amounts payable under the Plan are valued at the fair market value of the related assets and total $1.6 million and $1.3 million, respectively. Amounts deferred for executive officers participating in the nonqualified deferred compensation plan are included in the Summary Compensation Table above.

Compensation Committee Interlocks and Insider Participation

The Board of Directors' Compensation Committee is composed of Pauline T. Hughes, Kristine F. Hughes and Richard G. Hinckley.

THE FOLLOWING REPORT OF THE COMPENSATION COMMITTEE AND THE PERFORMANCE GRAPH THAT APPEARS IMMEDIATELY AFTER SUCH REPORT SHALL NOT BE DEEMED TO BE SOLICITNG MATERIAL OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO FILED.

To: The Board of Directors

As members of the Compensation Committee (the "Committee"), it is our duty to administer or supervise various stock option and incentive compensation plans of the Company. In addition, the Committee recommends to the Board of Directors the compensation to be paid to the Company's chief executive and operating officers. The Committee also reviews compensation policies applicable to officers and key employees and considers the relationship of corporate performance to that compensation.

The Committee submits a report to the Board concerning the compensation policies followed by the Committee in recommending compensation for the Company's chief executive officer and chief operating officer. In establishing such compensation for 2001, the Committee considered a number of factors, including what it believed to be the competitive level of compensation that is necessary to attract, retain and motivate qualified officers. In this regard, the Committee reviewed several salary reports and surveys. The Committee also considered:

For 2001 salaries, the Committee applying the factors set forth above increased base salaries for the chief executive officer and chief operating officer approximately 7 percent over 2000 levels on a weighted average basis. In 2001, other salaries of executive officers were set by the chief executive officer and chief operating officer using the same factors as set forth above. The chief executive officer and chief operating officer approved percentage salary increases for the executive officers in 2002 and 2001 that were approximately the same as those approved by the Committee for the chief executive officer and the chief operating officer.

The compensation policy of the Company, which is endorsed by the Committee, is that a substantial portion of the annual compensation of each officer relate to and be contingent upon the performance of the Company, as well as the individual contribution of each officer. As a result, much of an officer's compensation is subject directly to annual bonus compensation measured by the Company's achievement of certain sales and income goals. Under the Company's Incentive Compensation Plan, bonuses are paid based on the officer's performance and the performance of the entire Company. The Committee believes the compensation paid to its officers is reasonable in view of the Company's performance and the contribution of the officers to that performance.

All officers and key employees participate in the Company's stock option plans. Options granted thereunder, may provide for the acceleration of vesting if the Company meets or exceeds certain income and/or revenue goals. The Committee believes that stock options have been effective in attracting, motivating and retaining executives and key employees. During 2001, the Committee recommended stock option grants in the aggregate amount of 1,018,490 shares.

Except for Kristine F. Hughes, no member of the Committee is a former or current officer or employee of the Company or any of its subsidiaries. Mrs. Hughes served as President and CEO of the Company from September 1996 to October 1997.

| COMPENSATION COMMITTEE | ||

Dated: April 10, 2002 |

Pauline T. Hughes Kristine F. Hughes Richard G. Hinckley |

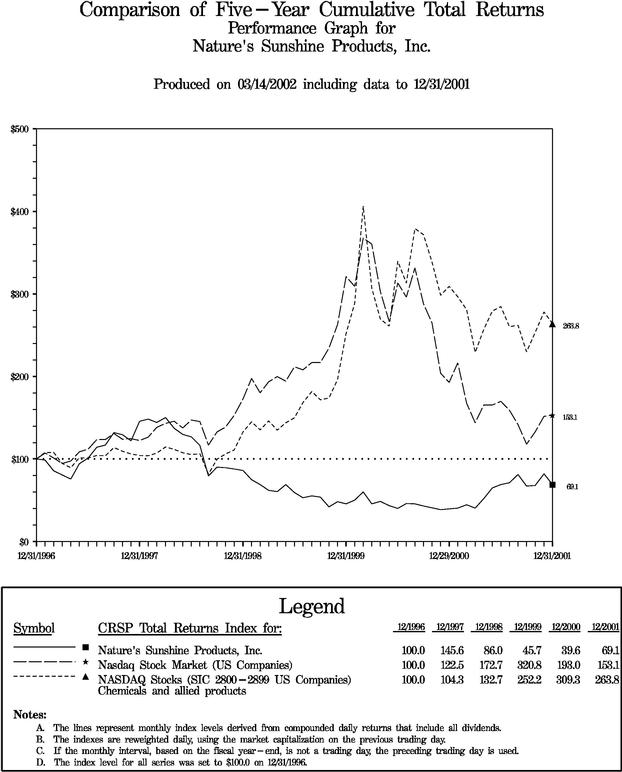

The following graph compares the performance (total return on investment as measured by the change in the year-end stock price plus reinvested dividends) of the Common Stock of the Company ("NATR") with that of the Index for NASDAQ National Stock Market (U.S. companies) and the Index for NASDAQ Stock (SIC 2800-2899) (herbal vitamins companies) for the five years ended December 31, 2001.

The Audit Committee of Nature's Sunshine Products, Inc., is composed of three independent directors and operates under written charter adopted by the Company's Board of Directors in 2001. The Audit Committee is currently comprised of Richard G. Hinckley (Chairman), Pauline T. Hughes and Kristine F. Hughes. During the period that each member has served on the Audit Committee, each has been "independent" as this term applies to Rule 4200(a)(15) of the National Association of Securities Dealers' ("NASD") and its listing standards.

To: The Board of Directors

We have reviewed and discussed with management the Company's audited financial statements as of and for the year ended December 31, 2001.

We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and letter from the independent auditors required by the Independence Standards Board, and have discussed with the auditors the auditor's independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001.

| AUDIT COMMITTEE | ||

Dated: April 10, 2002 |

Richard G. Hinckley Pauline T. Hughes Kristine F. Hughes |

RELATIONSHIP WITH

INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Board of Directors of the Company has recommended to the Board of Directors that Arthur Andersen LLP be selected again as the independent public accountants for the Company. The Board of Directors has accepted this recommendation and has selected Arthur Andersen LLP to be the independent public accountants for the Company for the fiscal year ending December 31, 2002. Arthur Andersen LLP served as the Company's independent public accountants for the fiscal year ended December 31, 2001. The Board of Directors and the Audit Committee will continue to closely monitor ongoing developments at Arthur Andersen LLP and, in their discretion, may change the appointment at any time during the year if they determine that such a change would be in the best interest of the Company and its shareholders.

Representatives of Arthur Andersen LLP are expected to attend the 2002 Annual Meeting and will have an opportunity to make a statement if they desire to do so, and they will be available to answer appropriate questions from stockholders.

Audit Fees

The aggregate audit fees billed by Arthur Andersen LLP for the annual audit for the fiscal year ended December 31, 2001, and for the reviews of financial statements included in the Company's Quarterly Reports on Form 10-Q during the last fiscal year were $222,193, of which $91,997 were billed for audit services related to the Company's non-U.S. subsidiaries.

Financial Information Systems Design and Implementation Fees

Arthur Andersen LLP did not render any professional services for information technology services relating to financial information systems design and implementation for the fiscal year ended December 31, 2001.

All Other Fees

The aggregate fees billed by Arthur Andersen LLP for services rendered to the Company, other than services described above under "Audit Fees" and "Financial Information Systems Design and Implementation Fees" for the fiscal year ended December 31, 2001, were $106,400. This included audit-related services of $3,790 and non-audit services pertaining to tax preparation and consultation of $102,610. Audit related services generally include fees for statutory audits, business acquisitions, accounting consultations and SEC registration statements.

If a stockholder wishes to present a proposal at the 2003 Annual Meeting of Stockholders, the proposal must be received by Nature's Sunshine Products, Inc., Stockholder Relations, 75 East 1700 South, Provo, Utah 84606, prior to December 31, 2002. The Board of Directors will review any proposal, which is received by that date and determine whether it is a proper proposal to present to the 2003 Annual Meeting.

A majority of the 16,229,641 outstanding shares of Common Stock of the Company shall constitute a quorum at the Annual Meeting. Under the Utah Revised Business Corporation Act, directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at the Annual Meeting provided a quorum is present. The affirmative vote of at least a majority of the shares represented at the meeting is required for all other proposals to come before the meeting. The Company does not have any specific charter or by-law provisions dealing with the method by which votes will be counted; however, in prior years the Company has counted abstentions and broker non-votes for quorum purposes by the votes represented by such shares are not counted in computing the results of the election of directors or other resolutions.

Votes cast by stockholders who attend and vote in person or by proxy at the Annual Meeting will be counted by inspectors to be appointed by the Company (it is anticipated that the inspectors will be employees, attorneys or agents of the Company).

As of the date of this Proxy Statement, the Board of Directors of the Company does not intend to present and has not been informed that any other person intends to present a matter for action at the 2002 Annual Meeting other than as set forth herein and in the Notice of Annual Meeting. If any other matter properly comes before the meeting, it is intended that the holders of Proxies will act in accordance with their best judgment. The Board of Directors may read the minutes of the 2001 Annual Meeting of Stockholders and make reports, but stockholders will not be required to approve or disapprove such minutes or reports.

In addition to the solicitation of Proxies by mail, certain of the officers and employees of the Company, without extra compensation, may solicit proxies personally or by telephone. The Company will also request brokerage houses, nominees, custodians and fiduciaries to forward soliciting materials to the beneficial owners of Common Stock held of record and will reimburse such persons for forwarding such material. The cost of this solicitation of Proxies will be borne by the Company.

Copies of the Company's Annual Report on Form 10-K (including financial statements and financial statement schedules) filed with the Securities and Exchange Commission may be obtained without charge by writing to the Company—Attn: Investor Relations Dept., 75 East 1700 South, Provo, UT 84606 or via the Company's web site at www.natr.com. Copies of the Company's 2001 Annual Report to Shareholders are being mailed with this Proxy Statement.

The enclosed Proxy is furnished for you to specify your choices with respect to the matters referred to in the accompanying notice and described in this Proxy Statement. If you wish to vote in accordance with the board's recommendations, please sign, date and return the Proxy in the enclosed envelope which requires no postage if mailed in the United States. A prompt return of your Proxy will be appreciated.

| Dated: April 10, 2002 | By Order of the Board of Directors, | |

/s/ Brent F. Ashworth |

||

BRENT F. ASHWORTH Secretary |

Please date, sign and mail your

proxy card back as soon as possible!

Annual Meeting of Shareholders

NATURE'S SUNSHINE PRODUCTS, INC.

May 24, 2002

Please Detach and Mail in the Envelope Provided

| A | ý | Please mark your votes as in this example. |

| FOR | WITHHELD | ||||||

| 1. | Election of Directors. |

o | o | Nominees: | Kristine F. Hughes Daniel P. Howells |

2. | In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting. |

(INSTRUCTION: To withhold authority to vote for any individual nominee, write that nominee's name on the space provided below.) |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2. |

||||||

Please sign and date this Proxy where shown below and return it promptly: |

|||||||

No postage is required if this Proxy is returned in the enclosed envelope and mailed in the United States. |

|||||||

SIGNATURE(S) |

DATE |

||||

| Note: | Please sign above exactly as the shares are issued. When shares are held by joint tenants, both should sign . When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.) | ||||

PROXY

NATURE'S SUNSHINE PRODUCTS, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Kristine F. Hughes and Brent F. Ashworth and each of them as Proxies, with full power of substitution, and hereby authorizes them to represent and vote, as designated on the reverse, all shares of Common Stock of the Company held of record by the undersigned on April 10, 2002, at the Annual Meeting of Shareholders to be held at the Company's corporate offices at 75 East 1700 South, Provo, Utah 84606, on Friday, May 24, 2002, at 10:00 a.m., local time, or at any adjournment thereof.

(To Be Signed on Reverse Side.)