Nature’s Sunshine Reports Second Quarter 2020 Results

LEHI, Utah – August 6, 2020 – Nature’s Sunshine Products, Inc. (Nature’s Sunshine) (NASDAQ: NATR), a leading natural health and wellness company, reported financial results for the second quarter ended June 30, 2020.

Second Quarter 2020 Financial Summary vs. Same Year‐Ago Quarter

•Net sales were $87.3 million compared to $90.7 million.

•GAAP net income increased significantly to $6.1 million, or $0.29 per diluted share, compared to $2.6 million, or $0.14 per diluted share.

•Adjusted net income per diluted share was $0.28, compared to an adjusted net income per diluted share of $0.15.

•Adjusted EBITDA increased 21% to $9.7 million compared to $8.0 million.

Management Commentary

“Throughout the second quarter, we continued to navigate the dynamic effects that the COVID-19 pandemic has had on our global markets,” said Terrence Moorehead, CEO of Nature’s Sunshine. “Despite mandated lockdowns across many of our geographies during the quarter, our NSP business returned to revenue growth in two key markets—the U.S. and China. In addition, our commitment to streamlining processes and prudently managing expenses through our ‘Right Stuff’ strategy has helped us deliver significant consolidated net income and adjusted EBITDA growth. I am proud of our global team’s continued hard work and adaptability during this unprecedented time.

“We are continuously adapting to changes in consumer behavior across our business. Demand for our products surged following the onset of the pandemic in mid-March, especially for our immune product line. While the increased demand slowed temporarily in April through mid-May, buying patterns soon stabilized and even accelerated for the remainder of the quarter, potentially signaling a long-term trend towards continued expansion and better engagement with the health-conscious consumer.

“Looking ahead, we will continue building upon the strong operational foundation we are putting in place with our five global growth strategies, which we call ‘The Fab Five.’ These constitute our key areas of operational focus as we prepare for the launch of our revamped business model in the third quarter. Our revitalized go-to-market plan will enhance our customer and distributor experience by improving our brand presence, including the launch of a revamped consumer-facing e-commerce website, expanding our digital and manufacturing capabilities, and streamlining our organizational structure. There remains much work to be done, but we are pleased with the progress we have made so far and look forward to continuing strong results from our global growth initiatives.”

Second Quarter 2020 Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net Sales by Operating Segment |

| | Three Months Ended June 30, 2020 | | Three Months Ended June 30, 2019 | | Percent Change | | Impact of Currency Exchange | | Percent Change Excluding Impact of Currency |

| Asia | $ | 32,757 | | | $ | 35,162 | | | (6.8) | % | | $ | (872) | | | (4.4) | % | |

| Europe | 15,465 | | | 15,075 | | | 2.6 | | | (232) | | | 4.1 | | |

| North America | 34,471 | | | 34,620 | | | (0.4) | | | (92) | | | (0.2) | | |

| Latin America and Other | 4,593 | | | 5,867 | | | (21.7) | | | (311) | | | (16.4) | | |

| | $ | 87,286 | | | $ | 90,724 | | | (3.8) | % | | $ | (1,507) | | | (2.1) | % | |

Net sales in the second quarter were $87.3 million compared to $90.7 million in the same year‐ago quarter. The decrease was attributable primarily to the effects of COVID-19-related market closures in South Korea and Latin America. Net sales were also negatively impacted by $1.5 million of unfavorable foreign currency exchange rate fluctuations. This was partially offset by growth in China and Europe.

Gross margin in the second quarter was 73.6% compared to 73.7% the year‐ago quarter.

Volume incentives as a percentage of net sales were 33.4% compared to 34.5% in the year-ago quarter.

Selling, general and administrative expenses in the second quarter decreased 8% to $28.5 million compared to $31.0 million in the year‐ago quarter. The decrease reflects continued savings from restructuring activities in the U.S. and Latin America, decreases in travel and event-related costs as a result of COVID-19, and an unexpected VAT refund in 2020. As a percentage of net sales, SG&A expenses decreased 150 basis points to 32.7% from 34.2% in the second quarter of 2019. Excluding the impact of restructuring and the VAT refund, SG&A expenses as a percentage of net sales were 32.8% in the second quarter of 2020 compared to 33.8% in the year-ago quarter.

Operating income in the second quarter of 2020 increased 45% to $6.6 million, or 7.6% of net sales, compared to $4.5 million, or 5.0% of net sales, in the second quarter of 2019. Excluding the impact of the unusual items noted above, operating income was $6.5 million, or 7.4% of net sales, compared to $4.9 million, or 5.4% of net sales, in the year-ago quarter.

Other income, net, in the second quarter of 2020 was $1.5 million compared to $0.3 million in the second quarter of 2019. Other income, net, primarily consisted of foreign exchange gains as a result of net changes in foreign currencies primarily in Asia, Europe and Latin America. The provision for income taxes was $2.0 million in the second quarter of 2020 compared to $2.2 million for the year-ago quarter.

GAAP net income attributable to common shareholders increased significantly to $5.8 million, or $0.29 per diluted common share, compared to $2.7 million, or $0.14 per diluted common share, in the second quarter of 2019. Net income attributable to NSP China was $1.9 million, or $0.10 per diluted common share, for the second quarter of 2020, compared to a loss of $0.3 million, or $(0.02) per diluted common share, for the second quarter of 2019.

Adjusted net income attributable to common shareholders was $5.6 million, or $0.28 per diluted common share, compared to $2.9 million, or $0.15 per diluted common share, in the prior year period. A reconciliation of adjusted net income to GAAP net income is provided in the attached financial tables.

Adjusted EBITDA increased 21% to $9.7 million in the second quarter compared to $8.0 million in the second quarter of 2019. This increase was driven primarily by the aforementioned net reduction in SG&A. Adjusted EBITDA, which is a non-GAAP financial measure, is defined here as net income from continuing operations before taxes, depreciation, amortization and other income/loss adjusted to exclude share-based compensation expense and certain noted adjustments. A reconciliation of Net Income to Adjusted EBITDA is provided in the financial tables below.

Balance Sheet and Cash Flow

Net cash provided by operating activities was $14.4 million for the six months ended June 30, 2020 compared to $1.1 million used by operating activities in the prior year period. Capital expenditures during the six months ended June 30, 2020 totaled $2.2 million compared to $2.8 million in the comparable period of 2019. As of June 30, 2020, the Company had cash and cash equivalents of $70.3 million and $5.4 million of debt.

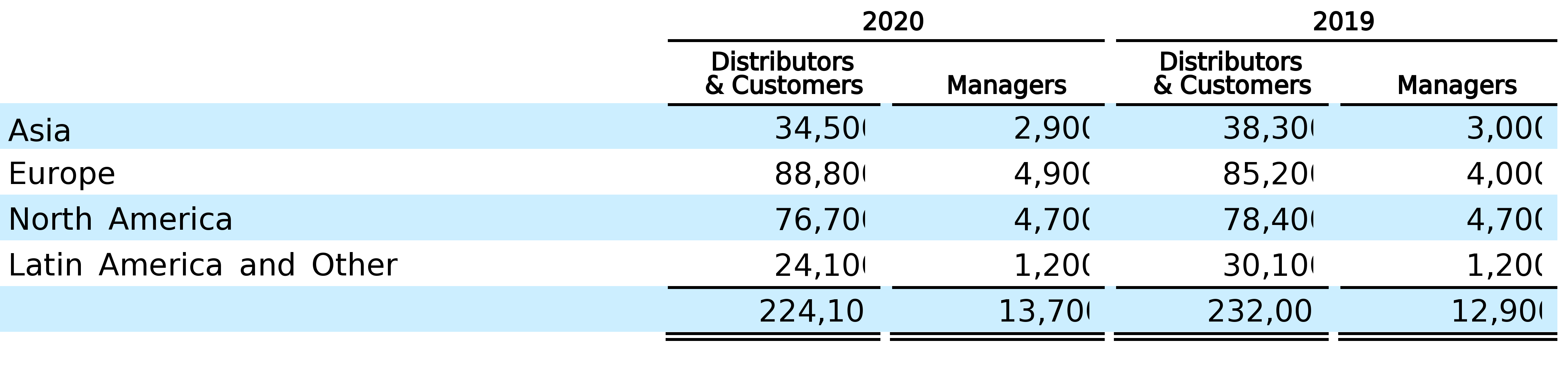

Active Distributors and Customers by Segment (1)

(1) Active Distributors and Customers include Nature’s Sunshine Products’ independent Distributors and

Customers who have purchased our products directly for resale and/or personal consumption during

the previous three months ended as of the date indicated. Total Managers, Distributors and Customers, which includes those who have made a purchase in the last twelve months, was 527,900 as of June 30, 2020.

In China, we sell our products through multiple channels, including cross-border e-commerce, wholesale, direct sellers and independent service providers who are compensated for marketing, sales support, and other services.

Conference Call

The Company will hold a conference call today at 5:00 p.m. Eastern time to discuss its second quarter 2020 results.

Date: Thursday, August 6, 2020

Time: 5:00 p.m. Eastern time (3:00 p.m. Mountain time)

Toll-free dial-in number: 1-866-548-4713

International dial-in number: 1-323-794-2093

Conference ID: 7890535

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 1-949-574-3860.

The conference call will be broadcast live and available for replay at http://public.viavid.com/player/index.php?id=140888 and via the Events section of the Nature’s Sunshine website.

A replay of the conference call will be available after 8:00 p.m. Eastern time on the same day through August 20, 2020.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 7890535

About Nature’s Sunshine Products

Nature’s Sunshine Products (NASDAQ: NATR), a leading natural health and wellness company, markets and distributes nutritional and personal care products in more than 40 countries. Nature’s Sunshine manufactures most of its products through its own state-of-the-art facilities to ensure its products continue to set the standard for the highest quality, safety and efficacy on the market today. Additional information about the company can be obtained at its website, www.naturessunshine.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements regarding the Company’s future business expectations, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may include, but are not limited to, statements relating to the Company’s objectives, plans, strategies and financial results. All statements (other than statements of historical fact) that address activities, events or developments that the Company intends, expects, projects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions, and are based on assumptions and assessments made by management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, including the following:

•adverse impacts of the global COVID-19 pandemic;

•laws and regulations regarding direct selling may prohibit or restrict our ability to sell our products in some markets or require us to make changes to our business model in some markets;

•extensive government regulations to which the Company's products, business practices and manufacturing activities are subject;

•legal challenges to the Company's direct selling program or to the classification of its independent distributors;

•impact of anti-bribery laws, including the U.S. Foreign Corrupt Practices Act;

•the Company’s ability to attract and retain independent distributors;

•the loss of one or more key independent distributors who have a significant sales network;

•the Company’s joint venture for operations in China with Fosun Industrial Co., Ltd.;

•registration of products for sale in foreign markets, or difficulty or increased cost of importing products into foreign markets;

•cybersecurity threats and exposure to data loss;

•the storage, processing, and use of data, some of which contain personal information, are subject to complex and evolving privacy and data protection laws and regulations;

•reliance on information technology infrastructure;

•the effect of fluctuating foreign exchange rates;

•liabilities and obligations arising from improper activity by the Company’s independent distributors;

•failure of the Company’s independent distributors to comply with advertising laws;

•changes to the Company’s independent distributor compensation plans;

•geopolitical issues and conflicts;

•negative consequences resulting from difficult economic conditions, including the availability of liquidity or the willingness of the Company’s customers to purchase products;

•risks associated with the manufacturing of the Company's products;

•uncertainties relating to the application of transfer pricing, duties, value-added taxes, and other tax regulations, and changes thereto;

•changes in tax laws, treaties or regulations, or their interpretation;

•actions on trade relations by the U.S. and foreign governments;

•product liability claims;

•the sufficiency of trademarks and other intellectual property rights; and

•our cannabidiol (CBD) product line is subject to varying, rapidly changing laws, regulations, and rules.

These and other risks and uncertainties that could cause actual results to differ from predicted results are more fully detailed under the caption “Risk Factors” in our reports filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K and Quarterly Reports filed on Form 10-Q.

All forward-looking statements speak only as of the date of this press release and are expressly qualified in their entirety by the cautionary statements included in or incorporated by reference into this press release. Except as is required by law, the Company expressly disclaims any obligation to publicly release any revisions to forward-looking statements to reflect events after the date of this press release.

Non-GAAP Financial Measures

We have included information which has not been prepared in accordance with generally accepted accounting principles (GAAP), such as information concerning non-GAAP net income, Adjusted EBITDA and net sales excluding the impact of foreign currency exchange fluctuations.

We utilize the non-GAAP measures of non-GAAP net income and Adjusted EBITDA in the evaluation of our operations and believe that these measures are useful indicators of our ability to fund our business. These non-GAAP financial measures should not be considered as an alternative to, or more meaningful than, U.S. GAAP net income (loss) as an indicator of our operating performance.

Other companies may use the same or similarly named measures, but exclude different items, which may not provide investors with a comparable view of Nature’s Sunshine Products’ performance in relation to other companies. We have included a reconciliation of Net Income to Adjusted EBITDA, the most comparable GAAP measure. We have also included a reconciliation of GAAP net income to Non-GAAP net income and Non-GAAP Adjusted EPS, in the attached financial tables.

Net sales in local currency removes, from net sales in U.S. dollars, the impact of changes in exchange rates between the U.S. dollar and the functional currencies of our foreign subsidiaries. This is accomplished by translating the current period net sales into U.S. dollars using the same foreign currency exchange rates that were used to translate the net sales for the previous comparable period.

We believe presenting the impact of foreign currency fluctuations is useful to investors because it allows a more meaningful comparison of net sales of our foreign operations from period to period. Net sales excluding the impact of foreign currency fluctuations should not be considered in isolation or as an alternative to net sales in U.S. dollar measures that reflect current period exchange rates, or to other financial measures calculated and presented in accordance with U.S. GAAP.

Investor Relations:

Gateway Investor Relations

Cody Slach

1-949-574-3860

NATR@gatewayir.com

NATURE’S SUNSHINE PRODUCTS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in thousands, except per share information)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net sales | $ | 87,286 | | | $ | 90,724 | | | $ | 183,212 | | | $ | 181,996 | |

| Cost of sales | 23,017 | | | 23,865 | | | 47,698 | | | 47,294 | |

| Gross profit | 64,269 | | | 66,859 | | | 135,514 | | | 134,702 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Volume incentives | 29,165 | | | 31,302 | | | 62,183 | | | 62,315 | |

| Selling, general and administrative | 28,504 | | | 31,019 | | | 59,569 | | | 64,871 | |

| Operating income | 6,600 | | | 4,538 | | | 13,762 | | | 7,516 | |

| Other income (loss), net | 1,509 | | | 306 | | | (901) | | | 258 | |

| Income before provision for income taxes | 8,109 | | | 4,844 | | | 12,861 | | | 7,774 | |

| Provision for income taxes | 1,976 | | | 2,215 | | | 3,722 | | | 3,416 | |

| Net income | 6,133 | | | 2,629 | | | 9,139 | | | 4,358 | |

| Net income (loss) attributable to noncontrolling interests | 379 | | | (60) | | | 423 | | | (88) | |

| Net income attributable to common shareholders | $ | 5,754 | | | $ | 2,689 | | | $ | 8,716 | | | $ | 4,446 | |

| | | | | | | |

| Basic and diluted net income per common share: | | | | | | | |

| | | | | | | |

| Basic earnings per share attributable to common shareholders | $ | 0.30 | | | $ | 0.14 | | | $ | 0.45 | | | $ | 0.23 | |

| | | | | | | |

| Diluted earnings per share attributable to common shareholders | $ | 0.29 | | | $ | 0.14 | | | $ | 0.44 | | | $ | 0.23 | |

| | | | | | | |

| Weighted average basic common shares outstanding | 19,491 | | | 19,291 | | | 19,472 | | | 19,280 | |

| Weighted average diluted common shares outstanding | 19,783 | | | 19,602 | | | 19,725 | | | 19,596 | |

NATURE’S SUNSHINE PRODUCTS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2020 | | December 31, 2019 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 70,255 | | | $ | 53,629 | |

| Accounts receivable, net of allowance for doubtful accounts of $423 and $407, respectively | 7,075 | | | 7,319 | |

| Inventories | 50,166 | | | 46,666 | |

| Prepaid expenses and other | 6,577 | | | 5,091 | |

| Total current assets | 134,073 | | | 112,705 | |

| | | |

| Property, plant and equipment, net | 56,687 | | | 59,512 | |

| Operating lease right-of-use assets | 20,572 | | | 23,951 | |

| Investment securities - trading | 1,035 | | | 1,150 | |

| Intangible assets, net | 511 | | | 567 | |

| Deferred income tax assets | 3,977 | | | 4,899 | |

| Other assets | 10,074 | | | 10,284 | |

| Total assets | $ | 226,929 | | | $ | 213,068 | |

| | | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 4,100 | | | $ | 4,406 | |

| Accrued volume incentives and service fees | 20,172 | | | 18,893 | |

| Accrued liabilities | 25,424 | | | 25,531 | |

| Deferred revenue | 1,845 | | | 1,266 | |

| Related party notes payable | 1,537 | | | 1,518 | |

| Income taxes payable | 2,038 | | | 1,392 | |

| Current portion of operating lease liabilities | 4,416 | | | 4,941 | |

| Current portion of note payable | 2,407

| | | — | |

| Total current liabilities | 61,939 | | | 57,947 | |

| | | |

| Liability related to unrecognized tax benefits | 1,364 | | | 1,499 | |

| Long-term portion of operating lease liabilities | 17,530 | | | 20,213 | |

| Long-term note payable | 2,967 | | | — | |

| Deferred compensation payable | 1,035 | | | 1,150 | |

| Deferred income tax liabilities | 1,645 | | | 1,655 | |

| Other liabilities | 1,214 | | | 1,168 | |

| Total liabilities | 87,694 | | | 83,632 | |

| | | |

| Shareholders’ equity: | | | |

| Common stock, no par value, 50,000 shares authorized, 19,510 and 19,410 shares issued and outstanding, respectively | 136,661 | | | 135,741 | |

| Retained earnings | 13,409 | | | 4,693 | |

| Noncontrolling interest | 650 | | | 227 | |

| Accumulated other comprehensive loss | (11,485) | | | (11,225) | |

| Total shareholders’ equity | 139,235 | | | 129,436 | |

| Total liabilities and shareholders’ equity | $ | 226,929 | | | $ | 213,068 | |

NATURE’S SUNSHINE PRODUCTS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2020 | | 2019 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 9,139 | | | $ | 4,358 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Provision for doubtful accounts | 17 | | | 30 | |

| Depreciation and amortization | 5,070 | | | 4,987 | |

| Non-cash lease expense | 2,257 | | | 2,792 | |

| Share-based compensation expense | 1,130 | | | 851 | |

| Loss on sale of property, plant and equipment | 6 | | | 3 | |

| Deferred income taxes | 912 | | | 365 | |

| Purchase of trading investment securities | (35) | | | (57) | |

| Proceeds from sale of trading investment securities | 146 | | | 105 | |

| Realized and unrealized losses (gains) on investments | 4 | | | (173) | |

| Foreign exchange losses (gains) | 996 | | | (205) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 173 | | | (1,035) | |

| Inventories | (4,114) | | | (2,052) | |

| Prepaid expenses and other current assets | (1,523) | | | (259) | |

| Other assets | (69) | | | (767) | |

| Accounts payable | (138) | | | (1,226) | |

| Accrued volume incentives and service fees | 1,523 | | | (235) | |

| Accrued liabilities | 59 | | | (6,203) | |

| Deferred revenue | 582 | | | 1,039 | |

| Lease liabilities | (2,072) | | | (2,340) | |

| Income taxes payable | 607 | | | (1,207) | |

| Liability related to unrecognized tax benefits | (135) | | | (40) | |

| Deferred compensation payable | (115) | | | 125 | |

| Net cash provided by (used in) operating activities | 14,420 | | | (1,144) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of property, plant and equipment | (2,210) | | | (2,774) | |

| Net cash used in investing activities | (2,210) | | | (2,774) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Principal payments of revolving credit facility | — | | | (547) | |

| Proceeds from revolving credit facility | — | | | 547 | |

| Proceeds from note payable | 5,374 | | | — | |

| Tax benefit from stock awards | (210) | | | (193) | |

| Net cash provided by (used in) financing activities | 5,164 | | | (193) | |

| Effect of exchange rates on cash and cash equivalents | (748) | | | (186) | |

| Net increase (decrease) in cash and cash equivalents | 16,626 | | | (4,297) | |

| Cash and cash equivalents at the beginning of the period | 53,629 | | | 50,638 | |

| Cash and cash equivalents at the end of the period | $ | 70,255 | | | $ | 46,341 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | |

| Cash paid for income taxes, net of refunds | $ | 2,143 | | | $ | 3,895 | |

| Cash paid for interest | 3 | | | 63 | |

NATURE’S SUNSHINE PRODUCTS, INC. AND SUBSIDIARIES

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net income | $ | 6,133 | | | $ | 2,629 | | | $ | 9,139 | | | $ | 4,358 | |

| Adjustments: | | | | | | | |

| Depreciation and amortization | 2,467 | | | 2,491 | | | 5,070 | | | 4,987 | |

| Share-based compensation expense | 736 | | | 621 | | | 1,130 | | | 851 | |

| Other (income) loss, net* | (1,509) | | | (306) | | | 901 | | | (258) | |

| Provision for income taxes | 1,976 | | | 2,215 | | | 3,722 | | | 3,416 | |

| Other adjustments (1) | (135) | | | 367 | | | (635) | | | 1,954 | |

| Adjusted EBITDA | $ | 9,668 | | | $ | 8,017 | | | $ | 19,327 | | | $ | 15,308 | |

| | | | | | | |

| | | | | | | |

| (1) Other adjustments | | | | | | | |

| Restructuring related expenses | $ | — | | | $ | 367 | | | $ | — | | | $ | 1,954 | |

| VAT refund | (135) | | | — | | | (635) | | | — | |

| Total adjustments | $ | (135) | | | $ | 367 | | | $ | (635) | | | $ | 1,954 | |

* Other (income) loss, net is primarily comprised of foreign exchange gains (losses), interest income, and interest expense.

NATURE’S SUNSHINE PRODUCTS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP NET INCOME TO

NON-GAAP NET INCOME and NON-GAAP ADJUSTED EPS

(Amounts in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net income | $ | 6,133 | | | $ | 2,629 | | | $ | 9,139 | | | $ | 4,358 | |

| Adjustments: | | | | | | | |

| Restructuring related expenses | — | | | 367 | | | — | | | 1,954 | |

| VAT refund | (135) | | | — | | | (635) | | | — | |

| Tax impact of adjustments | — | | | (140) | | | — | | | (743) | |

| Total adjustments | (135) | | | 227 | | | (635) | | | 1,211 | |

| Non-GAAP net income | $ | 5,998 | | | $ | 2,856 | | | $ | 8,504 | | | $ | 5,569 | |

| | | | | | | |

| Reported income attributable to common shareholders | $ | 5,754 | | | $ | 2,689 | | | $ | 8,716 | | | $ | 4,446 | |

| Total adjustments | (135) | | | 227 | | | (635) | | | 1,211 | |

| Non-GAAP net income attributable to common shareholders | $ | 5,619 | | | $ | 2,916 | | | $ | 8,081 | | | $ | 5,657 | |

| | | | | | | |

| Basic income per share, as reported | $ | 0.30 | | | $ | 0.14 | | | $ | 0.45 | | | $ | 0.23 | |

| Total adjustments, net of tax | (0.01) | | | 0.01 | | | (0.03) | | | 0.06 | |

| Basic income per share, as adjusted | $ | (0.29) | | | $ | 0.15 | | | $ | 0.42 | | | $ | 0.29 | |

| | | | | | | |

| Diluted income per share, as reported | $ | 0.29 | | | $ | 0.14 | | | $ | 0.44 | | | $ | 0.23 | |

| Total adjustments, net of tax | (0.01) | | | 0.01 | | | (0.03) | | | 0.06 | |

| Diluted income per share, as adjusted | $ | 0.28 | | | $ | 0.15 | | | $ | 0.41 | | | $ | 0.29 | |